Yields, Jobs, and Inflation - Oct 14 - Weekly Mortgage Update

A strong jobs report and inflation surprise pushed bond yields higher, with markets now waiting on the Fed's next move in November.

Request a Quote

A complete workup of your payment and closing costs on any home purchase or existing mortgage refinance. (no credit checks, Texas-only)

⭐️ Check This Out

No crash in sight, just a “correction.”

Inflation rose by 0.2% in September, slightly above forecasts, while jobless claims spiked due to the effects of Hurricane Helene and the Boeing strike.

Consumers are feeling optimistic—mortgage rates are set to fall! Now if only home prices would stop acting like they're on a trampoline...

September’s job growth exceeded expectations, easing fears of a recession and setting the stage for a controlled economic slowdown. Inflation still poses a challenge, though.

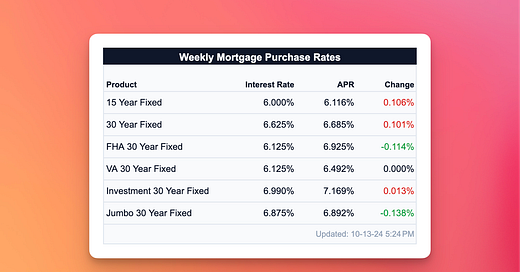

📊 Market Update

Between a strong jobs report, bond market ups and downs, and some inflation data that kept everyone on their toes, it's safe to say there was never a dull moment.

What’s the Deal with Rates?

Last Friday’s jobs report packed a punch, and the bond market definitely felt it. Imagine planning your day around a picnic, and then boom—surprise rainstorm.

That’s pretty much how the bond market reacted, sending yields higher and mortgage rates following suit. And just when you think the storm might clear, you look at the sky and realize, nope, it’s going to stick around for a while.

The magic number everyone is watching right now? 4.15%. That’s where 10-year Treasury yields were before all the labor market craziness started in early August. If yields push past that point, we may see rates climbing even higher.

Let’s just hope we’re not in a situation where rates keep pushing higher without any sign of relief. If yields can stabilize, it could give the market some breathing room—because honestly, I think we all deserve a little less financial whiplash.

The CPI Conundrum

You ever feel like you’re watching a horror movie and the monster just keeps coming back?

That’s kind of how the market feels about inflation right now. Thursday’s CPI report didn’t offer much relief—it came in hotter than expected at 0.3% instead of the forecasted 0.2%. Bond traders were not thrilled.

But just when it looked like rates would skyrocket, the jobless claims report showed a bigger-than-expected number of people filing for unemployment. The market seemed to take a breather, realizing that things might not be as strong as they looked. Because of that, rates started to calm down, and mortgage rates stayed steady for now.

Fed Watch: Nov 7 Meeting

So, here’s the lowdown on the upcoming Fed meeting—mark your calendars for November 7th! Everyone seems to think they’ve got the crystal ball on rates, and right now, the odds are looking like a 95.6% chance that the Fed will nudge the target rate down to the 4.50% to 4.75% range.

Not a huge drop, but hey, we’ll take it! After all, it’s a smidge lower than the current 4.75% to 5.00%.

But why the optimism?

Well, last week was full of ups and downs—first we got a jobs report that really shook things up, and then hotter-than-expected CPI numbers piled on more pressure. But the good news? Jobless claims came in higher than expected, which could be just the 'Hey, maybe we should ease up a bit!' signal the Fed needs to consider a rate cut.

Everyone’s watching that key 4.15% level for 10-year Treasury yields, so it’s no surprise traders are hoping for a rate cut. Whether the Fed actually makes that move is still uncertain, but after all the back and forth lately, I think we can all agree: a little calm as we head into the holiday season would be more than welcome.

Let's keep our fingers crossed for some stability.

Later This Week

Monday, October 14

Fed Waller: Speech by Federal Reserve Governor Christopher Waller

Tuesday, October 15

Fed Daly: Speech by Federal Reserve Bank of San Francisco President Mary Daly

Wednesday, October 16

No major reports scheduled

Thursday, October 17

Jobless Claims: Weekly report on the number of people filing for unemployment benefits

Retail Sales: Monthly report on consumer spending at retail stores

Friday, October 18

Building Permits: Monthly report on the number of new construction projects authorized

Housing Starts: Monthly report on the number of new residential construction projects that have begun

Fed Waller: Another speech by Federal Reserve Governor Christopher Waller