The Pivot Approaches - Sept 15 - Weekly Mortgage Update

This week's market awaits the Fed's big decision, with rising odds of a bold 50bps rate cut as inflation data underwhelms.

Request a Quote

A complete workup of your payment and closing costs on any home purchase or existing mortgage refinance. (no credit checks, Texas-only)

⭐️ Check This Out

2023-2024 mortgages: When your loan makes you want to take out a loan.

The Fed's balancing act: cut rates too much and inflation might throw a party, cut too little and recession might crash it.

Home inventory's up, prices are dipping, and sellers are pulling listings—looks like everyone’s waiting for that elusive “perfect” mortgage rate.

The Fed’s anticipated rate cut is expected to lower mortgage rates slightly, boosting housing affordability and demand, though rates have already partially adjusted.

The job market’s cooling, but not fast enough for a dramatic Fed move—just enough to keep everyone guessing whether it's a quarter or half-point cut.

📊 Market Update

This week’s market action felt like watching the buildup before the final match point in a championship game—lots of back-and-forth, some brief moments of excitement, but mostly everyone waiting for the big, game-changing move. Traders were holding their breath as inflation reports trickled in and speculation about the Fed’s next rate decision hit new heights.

The good news? The market made it through relatively unscathed, with no wild swings or major upsets.

The bad news? The real fireworks are still on the horizon. With the Fed meeting just around the corner, the stakes are only getting higher. But before we look ahead, let’s break down what happened this week.

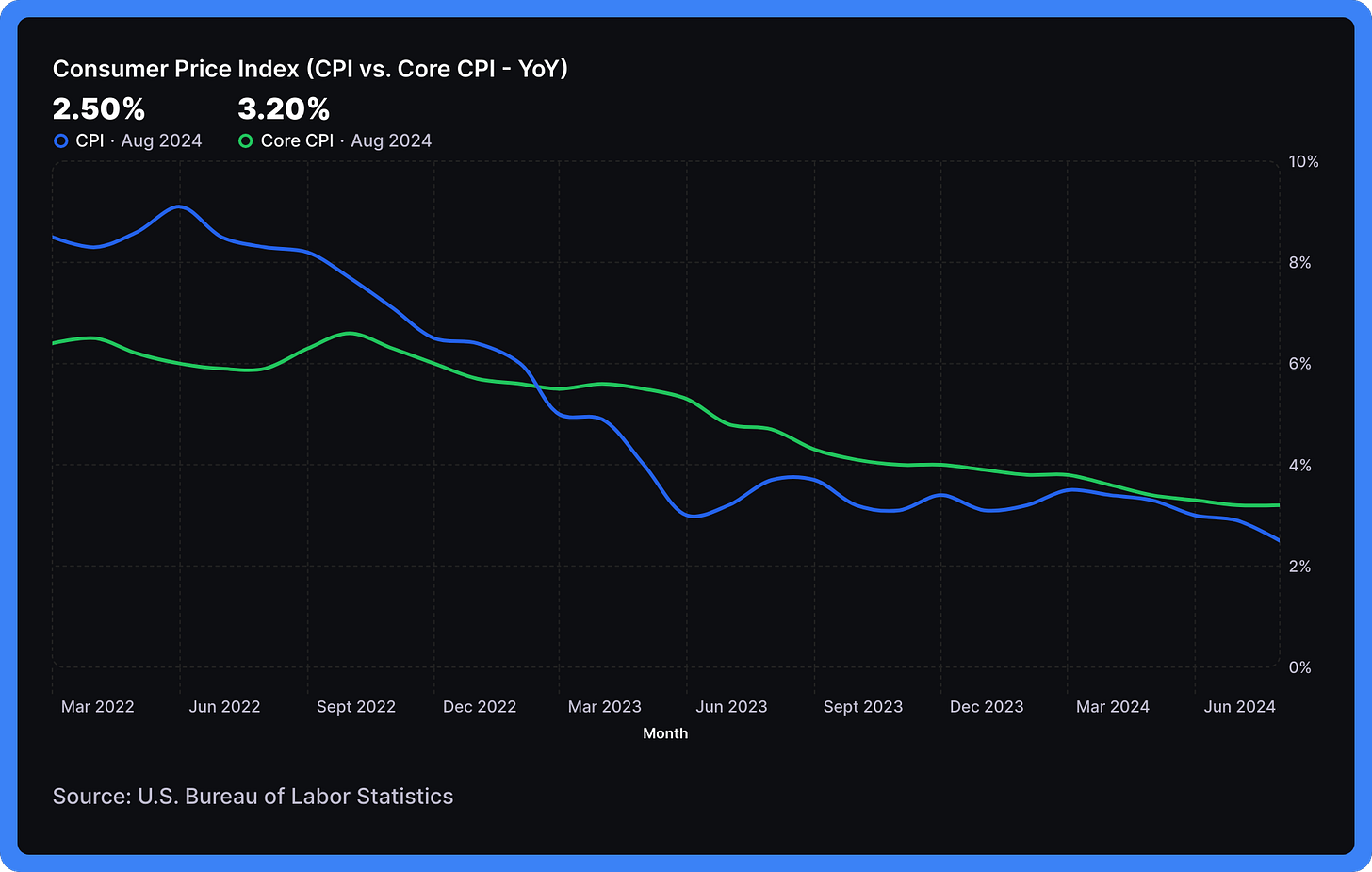

Inflation Data: Not as Scary as It Sounds

The much-anticipated CPI (Consumer Price Index) report dropped this week, and... it was pretty much what we expected. Sure, shelter costs ticked up slightly, making everyone hold their breath for a second, but overall, inflation data didn’t pack the punch some were bracing for.

It’s like when you open a bag of chips expecting a snack explosion, only to find it half-empty. Underwhelming, but not disastrous. The market barely blinked.

The real takeaway? Traders are laser-focused on the Fed’s next move, not the inflation drama.

Fed’s Rate Cut: The Big Decision Coming Soon

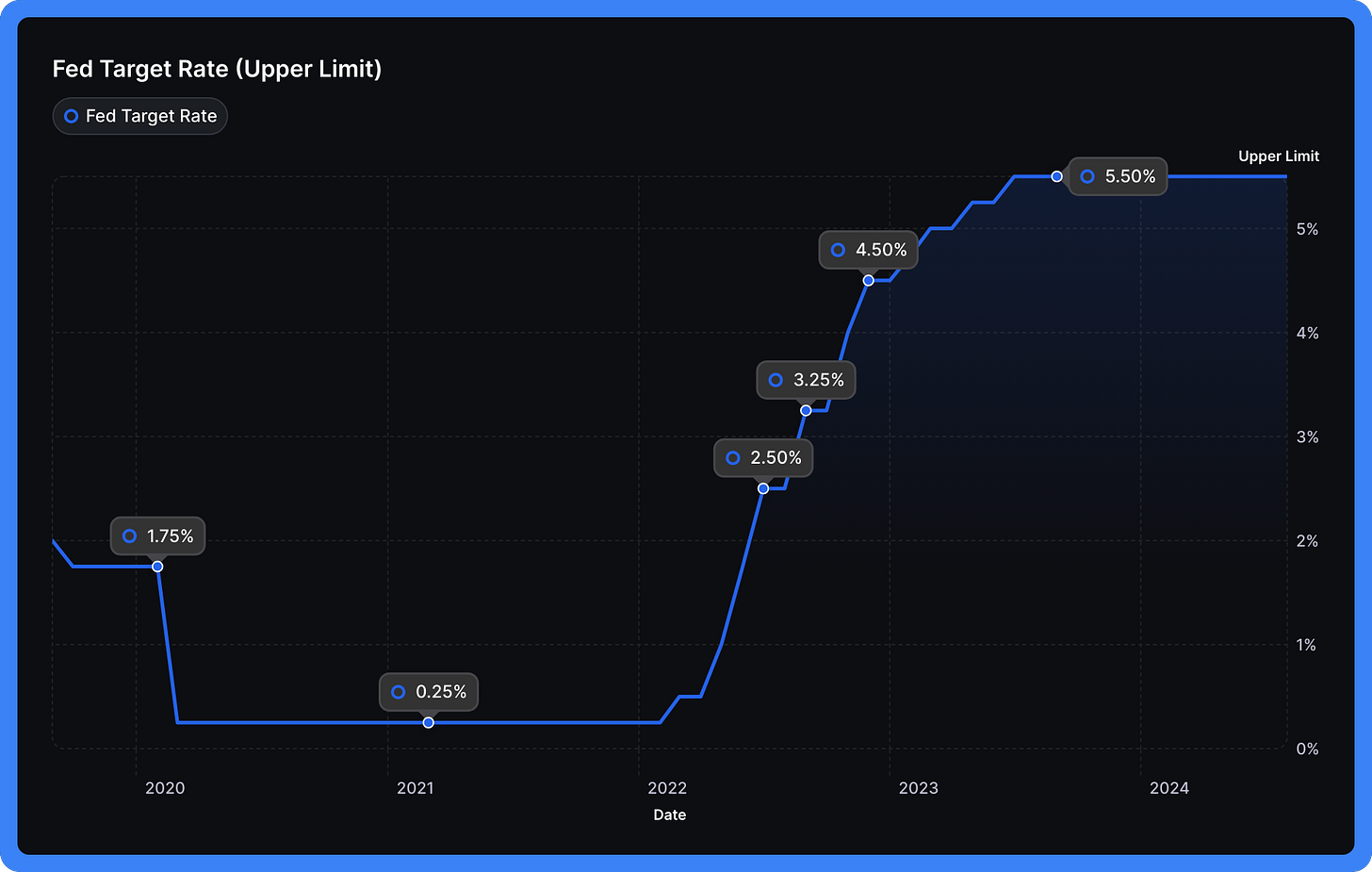

So, let’s talk about the elephant in the room: the looming Fed rate cut. The market is pretty confident we’re getting at least a 25bps (basis point) cut next week. But there’s still a whisper of uncertainty—could the Fed surprise us with a bolder 50bps cut?

Think of it as choosing between a regular cup of coffee and a double shot of espresso. Either way, we’re in for a jolt; the only question is how much.

And here’s where it gets even more interesting: according to the CME Fed Watch tool, the odds of a 50bps cut have jumped from 30% last week to 52% this week! The suspense is real, and now, more than half of market participants think the Fed might go for that extra jolt. ☕

The next big date on the calendar is September 18th, when the Fed will announce its latest decision on interest rates. The meeting is highly anticipated, especially with rising speculation around whether they’ll stick to a 25bps rate cut or surprise the market with a 50bps move.

The Fed typically releases its rate decision at 2:00 PM ET, followed by a press conference with Fed Chair Jerome Powell shortly after, where he’ll dive deeper into the reasoning behind their choice.

This announcement could spark significant market movements, so be sure to keep an eye out for the news next week.

Established in 1913, the Federal Reserve was a response to recurring financial panics in the U.S., particularly the Panic of 1907. Its creation aimed to provide a more stable and structured approach to managing the nation’s financial system.

Later This Week

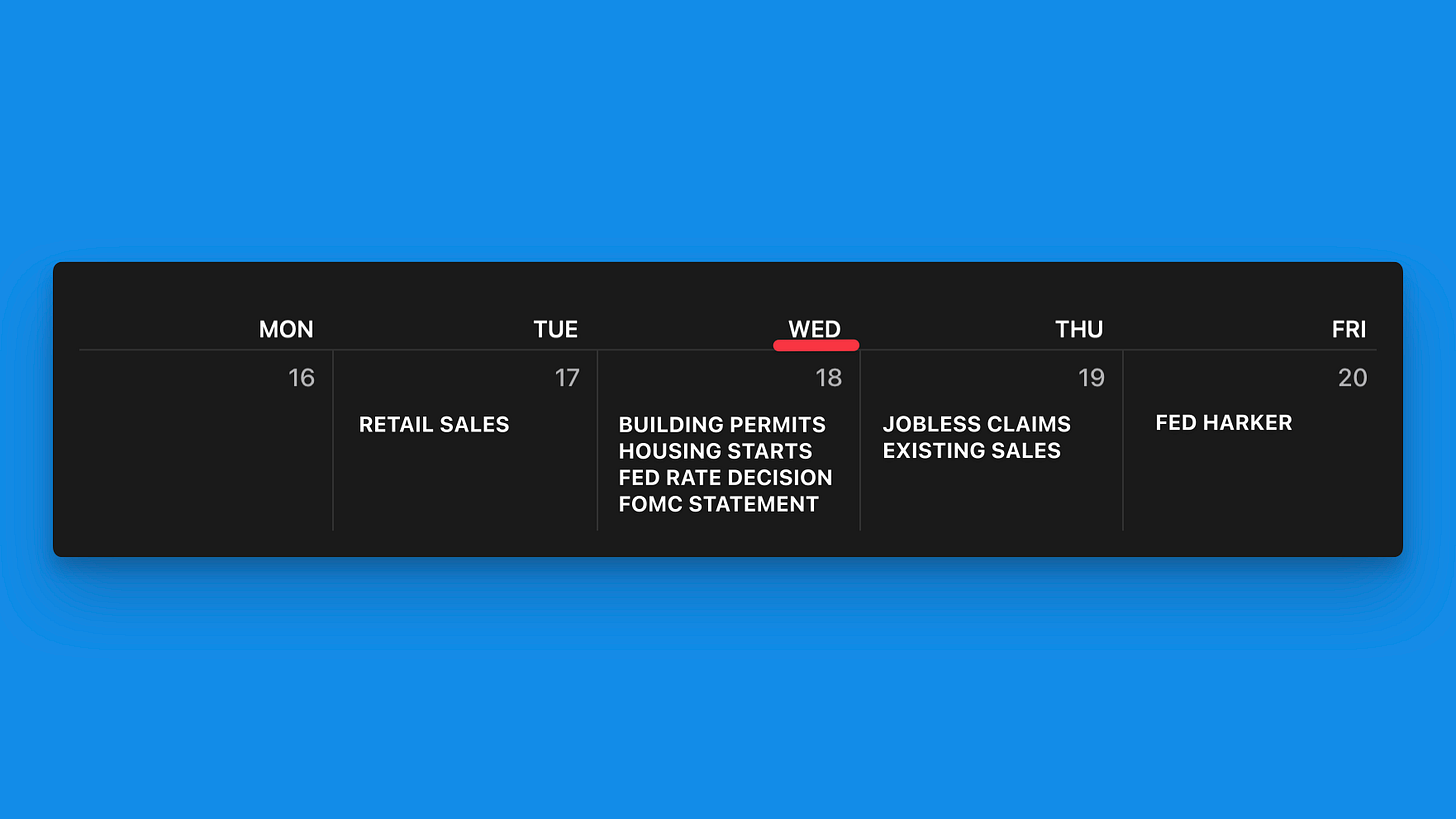

The economic week is dominated by Wednesday's events, featuring a potentially pivotal Federal Reserve meeting. The Fed's rate decision and FOMC statement are the main focus, with markets watching for signs of a policy shift.

Tuesday, 17

Retail Sales: Measures consumer spending on retail goods.

Wednesday, 18 ⭐

Building Permits: Indicates future construction activity.

Housing Starts: Measures the beginning of construction for new residential buildings.

🚨 Fed Rate Decision: Federal Reserve's decision on interest rates.

FOMC Statement: Federal Open Market Committee's statement on monetary policy.

Thursday, 19

Jobless Claims: Tracks the number of people filing for unemployment benefits.

Existing Sales: Measures sales of previously owned homes.

Friday, 20

Fed Harker: Likely refers to a speech or statement by Philadelphia Federal Reserve President Patrick Harker.