Rates: Rinse and Repeat - Oct 21 - Weekly Mortgage Update

Mortgage rates fluctuated this week, starting strong with easing oil prices, but stronger-than-expected economic data later pushed them back to the same levels that started the week.

Request a Quote

A complete workup of your payment and closing costs on any home purchase or existing mortgage refinance. (no credit checks, Texas-only)

⭐️ Check This Out

Elon’s SpaceX catches Starship with chopsticks while I still can’t even pick up sushi. 🍣 Looks like the future is now… unless you’re my takeout.

Zillow’s heat index: If you're house-hunting in Rochester, bring snacks—you'll be competing with every other buyer in town.

The housing market isn’t crashing, but with today’s mortgage rates, it’s more like watching paint dry—good news, though, prices might finally stop their slow climb.

23% of first-time buyers are holding off until after the election—because who doesn't love waiting to see which politician will fix affordable housing...again?

📊 Market Update

The mortgage market had a mixed week, bouncing between optimism and setbacks. Economic data surprised us a few times, nudging interest rates in different directions. Rates danced up and down like they were auditioning for 'Dancing with the Bonds,' mostly influenced by some unexpected economic reports.

Early in the week, there was a glimmer of hope.

De-escalation in the Middle East pushed oil prices down, which brought some relief to interest rates. But just as we started feeling good, Thursday's economic reports hit—and they hit hard.

Retail Sales and the Philly Fed index came in stronger than expected, putting pressure right back on rates.

This Week's Recap

With less global tension and falling oil prices, interest rates got a much-needed break to start the week. Now…oil prices and interest rates aren't always directly linked, but when oil drops enough, rates usually feel it too—which is good news for mortgage rates.

Plus, a weaker NY Fed Manufacturing Index added to the early optimism.

But then... Thursday hit.

We got a trio of stronger-than-expected economic reports:

Philly Fed Index: 10.3 (forecast: 3.0)

Retail Sales: +0.4% (forecast: +0.3%)

Jobless Claims: 241k (forecast: 260k)

These all beat expectations, putting upward pressure on interest rates.

Ten-year Treasury yields jumped from just under 4.04% to over 4.07%. Mortgage-Backed Securities (MBS) took a hit too, meaning mortgage rates gave back some early-week gains.

Yikes. 😬

Quick Look: How Interest Rates Affect Mortgage Rates

Why do changes in Treasury rates affect mortgage rates? 🤔

It's because mortgage rates are heavily influenced by the movement of long-term Treasury yields, especially the 10-year Treasury. When Treasury rates rise, mortgage rates usually follow.

This week’s strong Retail Sales, Philly Fed, and Jobless Claims data showed the economy is still holding strong. Investors worry that if things are too good, the Fed might keep interest rates high to fight inflation.

Mortgage rates often follow the 10-year Treasury because they are considered a benchmark for long-term interest rate trends. When investors move money away from bonds, bond prices fall and yields rise, which directly impacts mortgage rates, making them more expensive.

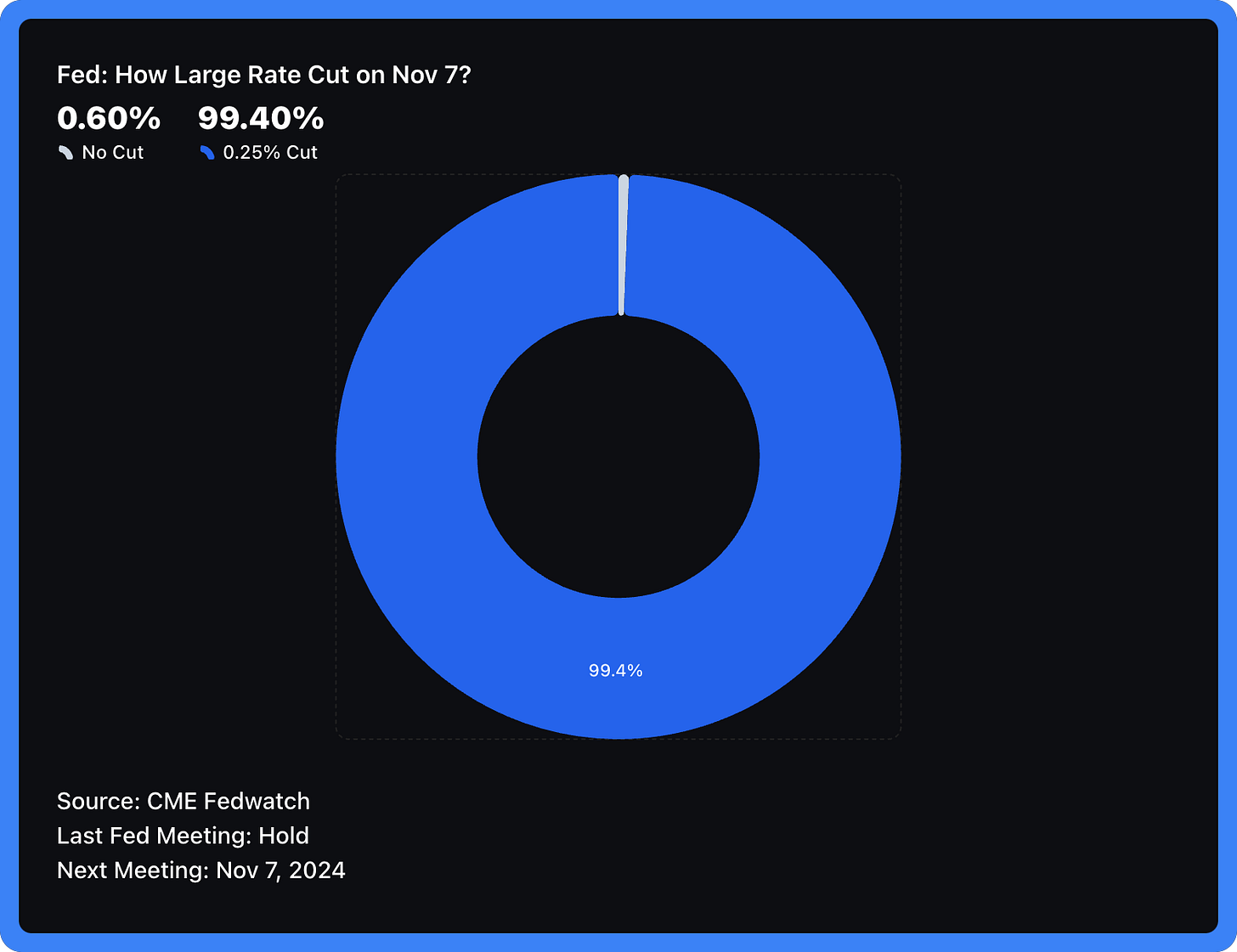

Fed Watch: November 7, 2024 Meeting

The next big thing on everyone's calendar is the Fed meeting on November 7th. So, what's the scoop?

Well, according to the probabilities, there's a 99.4% chance that the Fed will cut the target range to 4.50-4.75%, down from the current 4.75-5.00%. The odds of them keeping rates where they are is just 0.6%—so, a rate cut seems highly likely.

Picture the Fed as the conductor of a very nervous orchestra. Every musician (read: market participant) is watching for the slightest hint of a change. Right now, it seems like the conductor is sticking with the same tune, aiming for consistency rather than a surprise crescendo.

What does that mean for us? Stability—for now. But remember, the Fed is watching inflation data like a hawk. If the economic data continues to come in strong, we could see them deciding to keep rates higher for longer to cool things down.

For now, it’s all about waiting and watching. 🍿

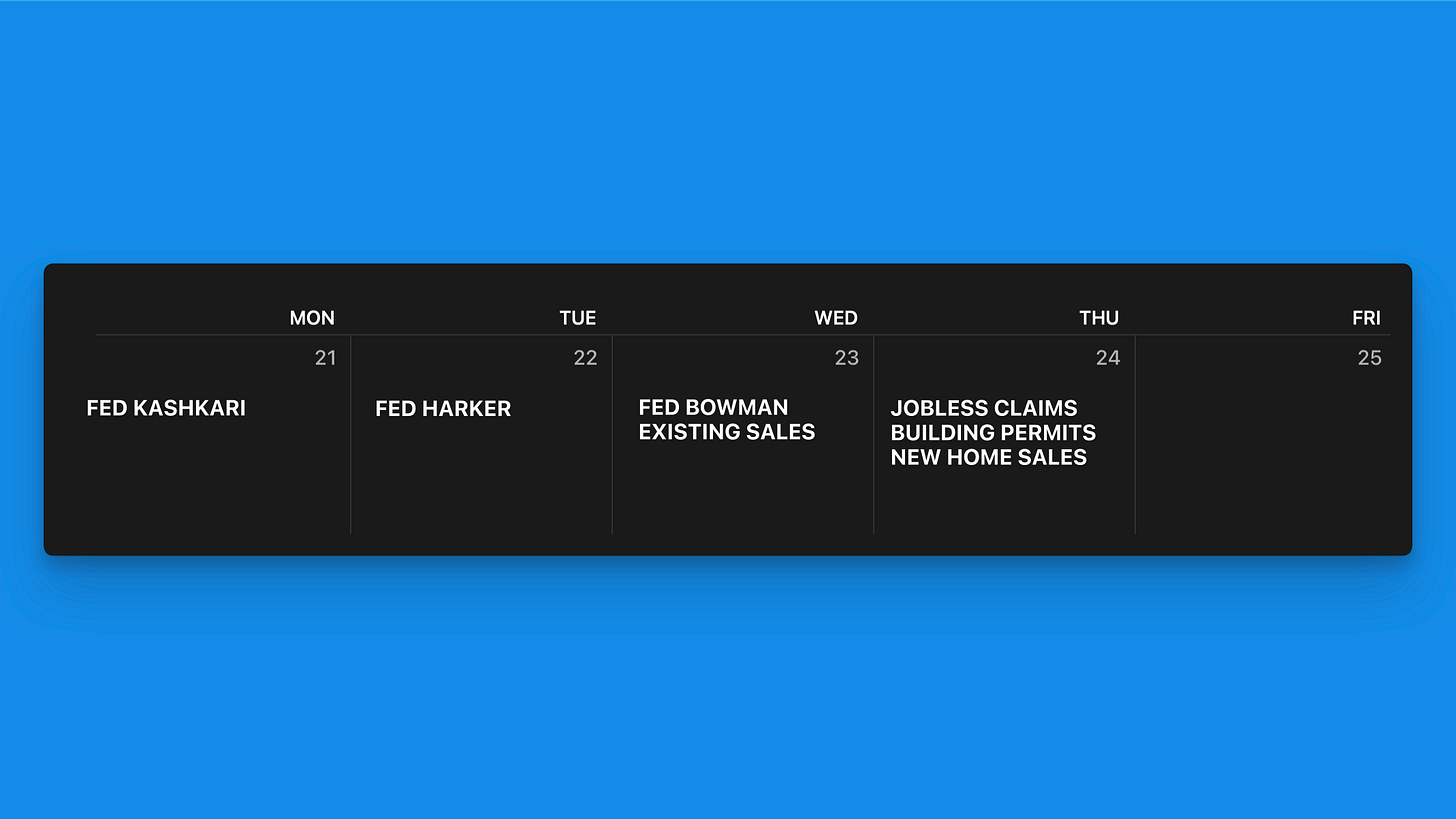

Later This Week

Monday, October 21

Fed Kashkari Speech: Neel Kashkari, a Federal Reserve official, will speak about economic outlook and monetary policy.

Tuesday, October 22

Fed Harker Speech: Patrick Harker, another Federal Reserve official, will provide insights into the current economic conditions and future policy expectations.

Wednesday, October 23

Fed Bowman Speech: Michelle Bowman from the Federal Reserve will discuss recent economic developments.

Existing Home Sales Report: Data showing the number of previously owned homes that were sold during the previous month.

Thursday, October 24

Jobless Claims Report: A report showing the number of people who filed for unemployment benefits in the past week.

Building Permits Data: Statistics on the number of permits issued for new construction, indicating future construction activity.

New Home Sales Report: Data detailing the number of newly constructed homes that were sold in the past month.