Rates Dip, Fed Maintains Course - Mar 25 - Weekly Mortgage Update

The Fed's unsurprising meeting outcome and strong housing market data lead to a slight decrease in mortgage rates, offering a glimmer of hope for homebuyers.

Request a Quote

A complete workup of your payment and closing costs on any home purchase or existing mortgage refinance. (no credit checks)

⭐️ Check This Out

Homebuilders are like desperate exes trying to win back their lost loves, offering flowers, chocolates, and even a discount on the relationship.

The Fed's dot plot is like a Magic 8-Ball for interest rates, predicting cuts in 2024 despite the economy's stubborn refusal to cooperate.

Homebuilders are staging a comeback by offering smaller homes and incentives that make buyers feel like they're getting a steal.

In the land of astronomical property taxes, New York and New Jersey reign supreme, where homeowners shell out more annually than most people make in a year.

AI-powered scammers are taking "fake it 'til you make it" to a whole new level in real estate, leaving agents and clients wondering if they're talking to a deepfake or the real deal.

📊 Market Update

Last week, all the attention was on the Fed meeting, and guess what? No big surprises! The Fed basically kept things as they were, which made investors pretty happy since they were worried about a worse outcome.

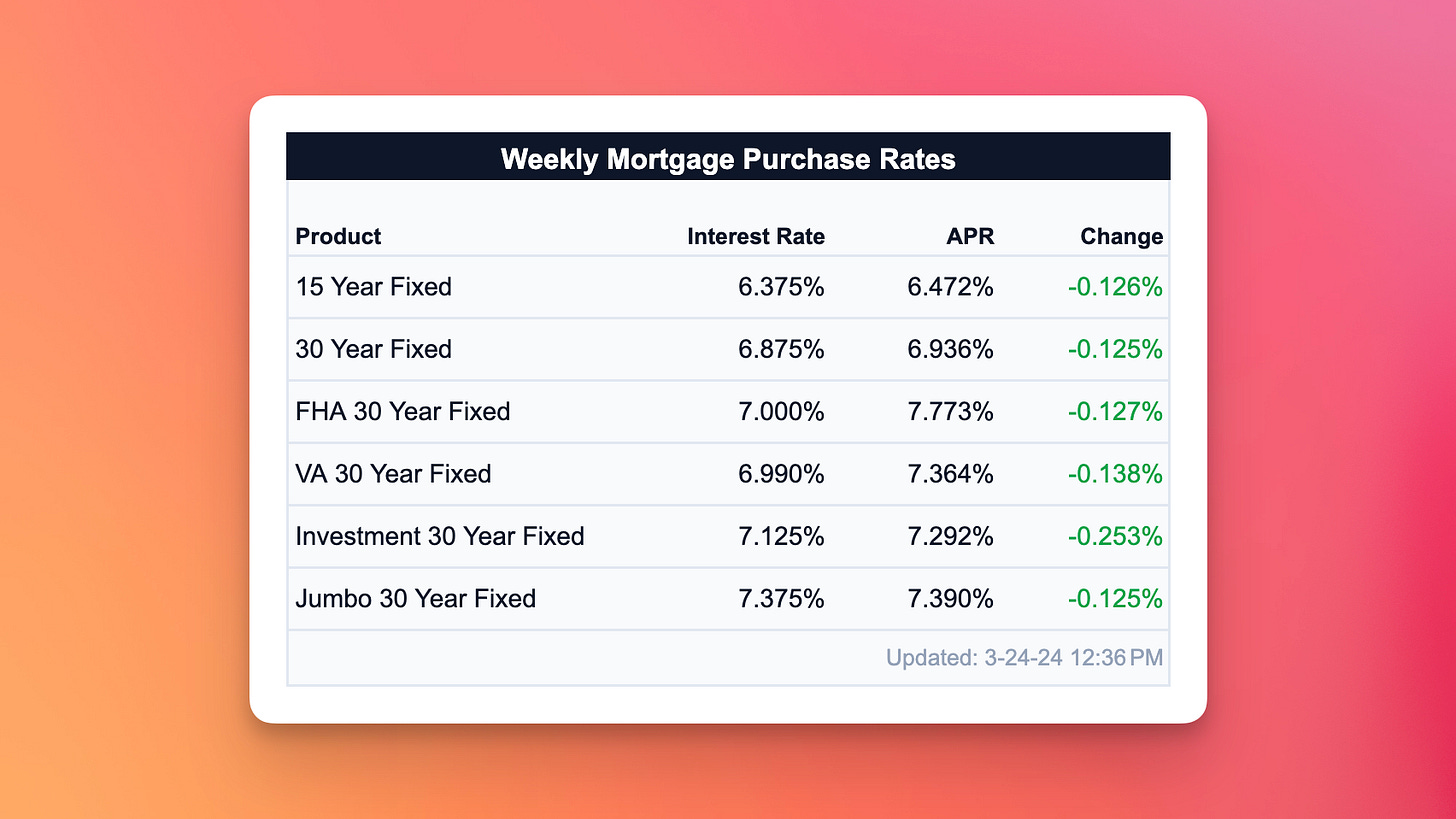

As a result, mortgage rates ended up a bit lower than before.

The Fed: No change

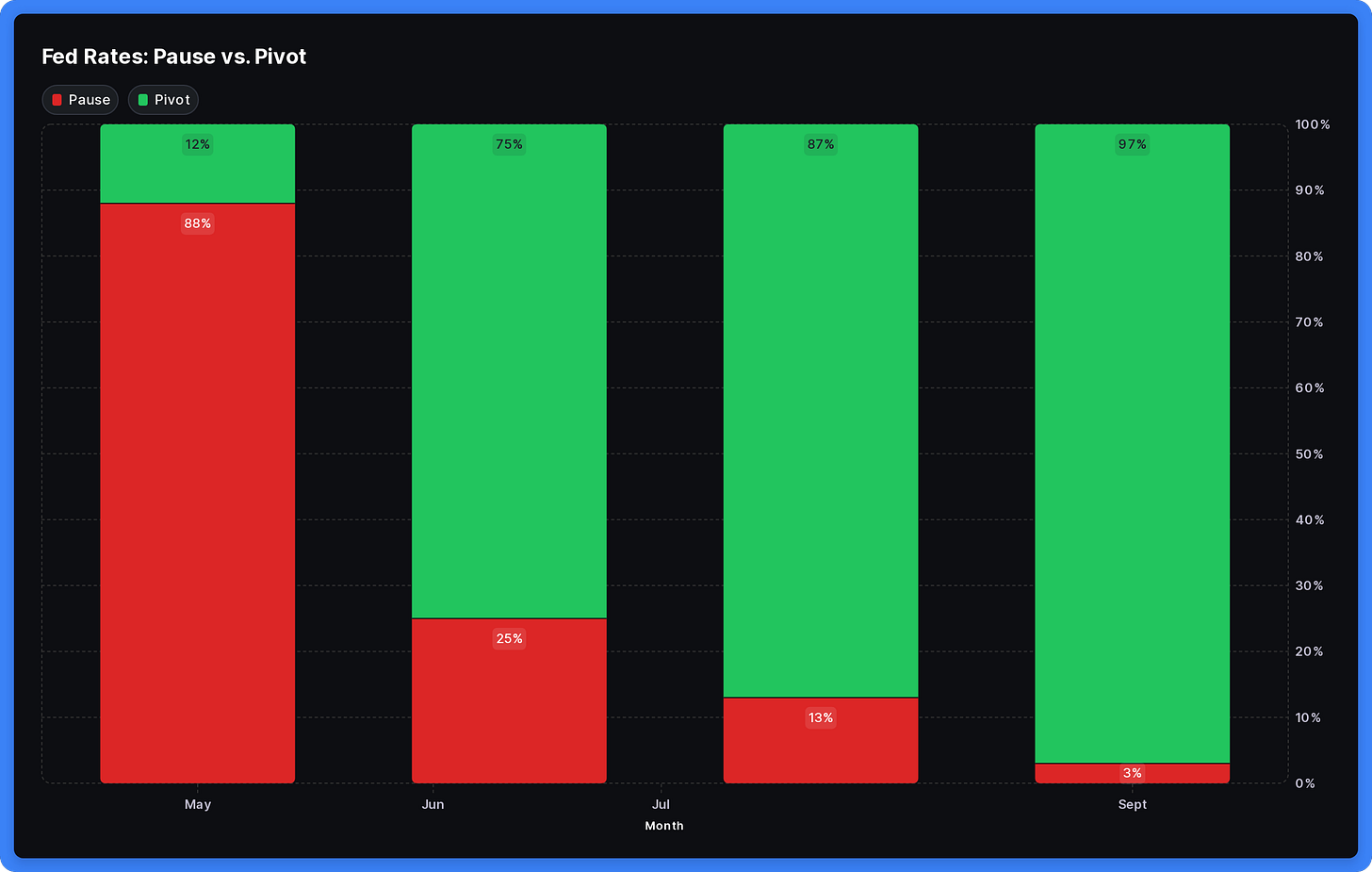

The Fed didn't change the federal funds rate for March, which was expected. What investors were really interested in was what the Fed thinks will happen with rates in the future. According to their predictions, they're still planning on three 0.25% rate cuts this year. What's interesting is that the Fed officials seem to be more in agreement about this outlook than before.

The Fed also raised their expectations for economic growth quite a bit, which shows that the economy has been doing pretty well lately. As for when the first rate cut will happen, investors think it'll be in June or July, just like they did before the meeting. It all depends on how inflation looks in the coming months.

The big question is whether the recent rise in inflation is just a temporary thing or if it means the downward trend has stopped. Fed Chair Powell thinks inflation is still slowly moving towards the 2% yearly target.

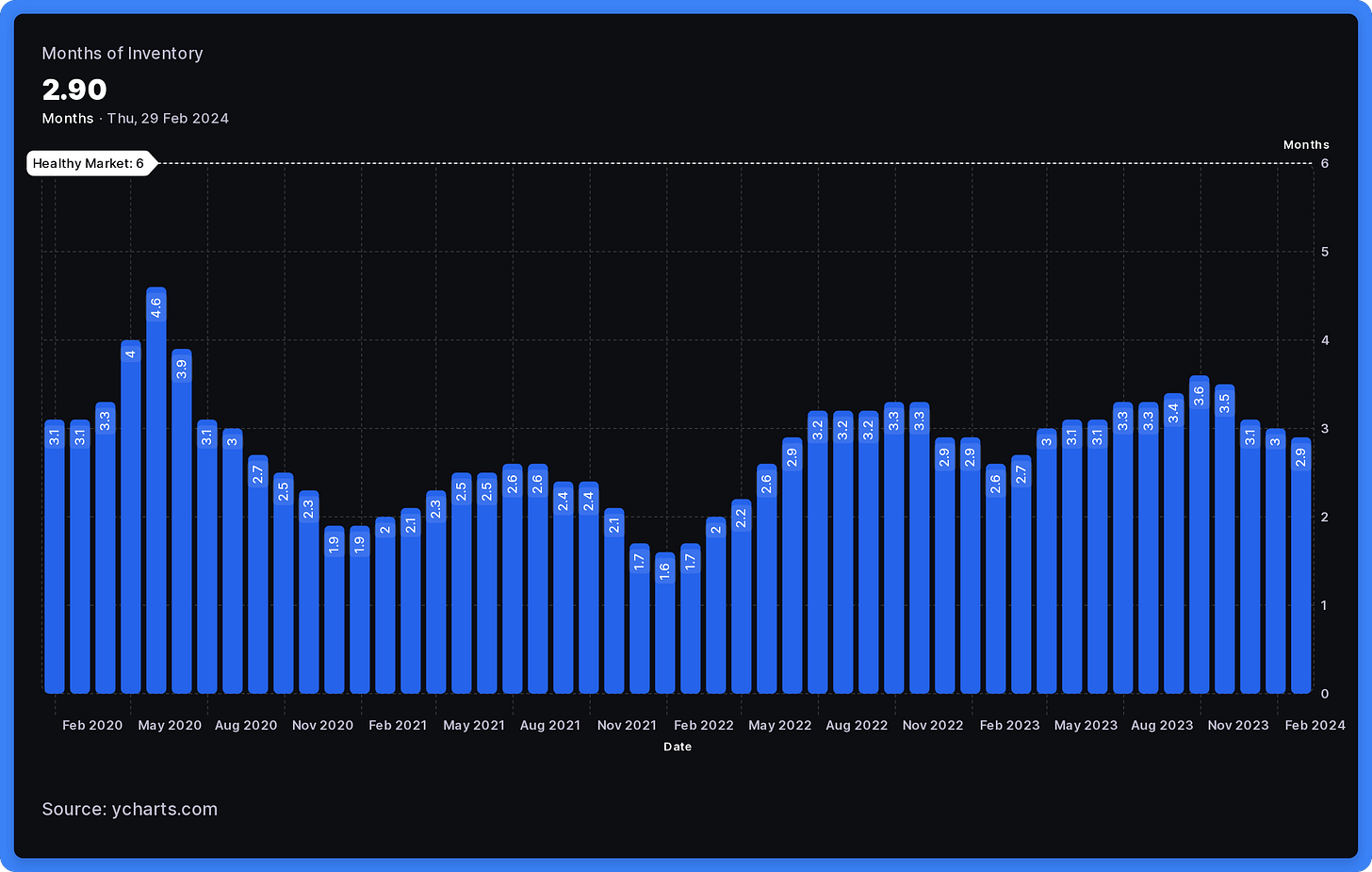

Inventory Still Too Low

Existing home sales in February jumped 10% from January, which was way better than experts predicted. However, sales were still a bit lower than this time last year. The problem is that there just aren't enough homes available - the current supply would only last about 2.9 months, much lower than the typical 6-month supply in a balanced market.

The median price for an existing home was $384,500, up 6% from a year ago.

Since there's a shortage of homes in many areas, we really need more houses built. The good news is that single-family housing starts (new construction) in February went up 12% from January and were 35% higher than a year ago. Building permits for single-family homes, which give us an idea of future construction, also reached the highest level since May 2022.

Plus, a survey showed that home builders feel more optimistic about the housing market than they have in eight months.

Later This Week

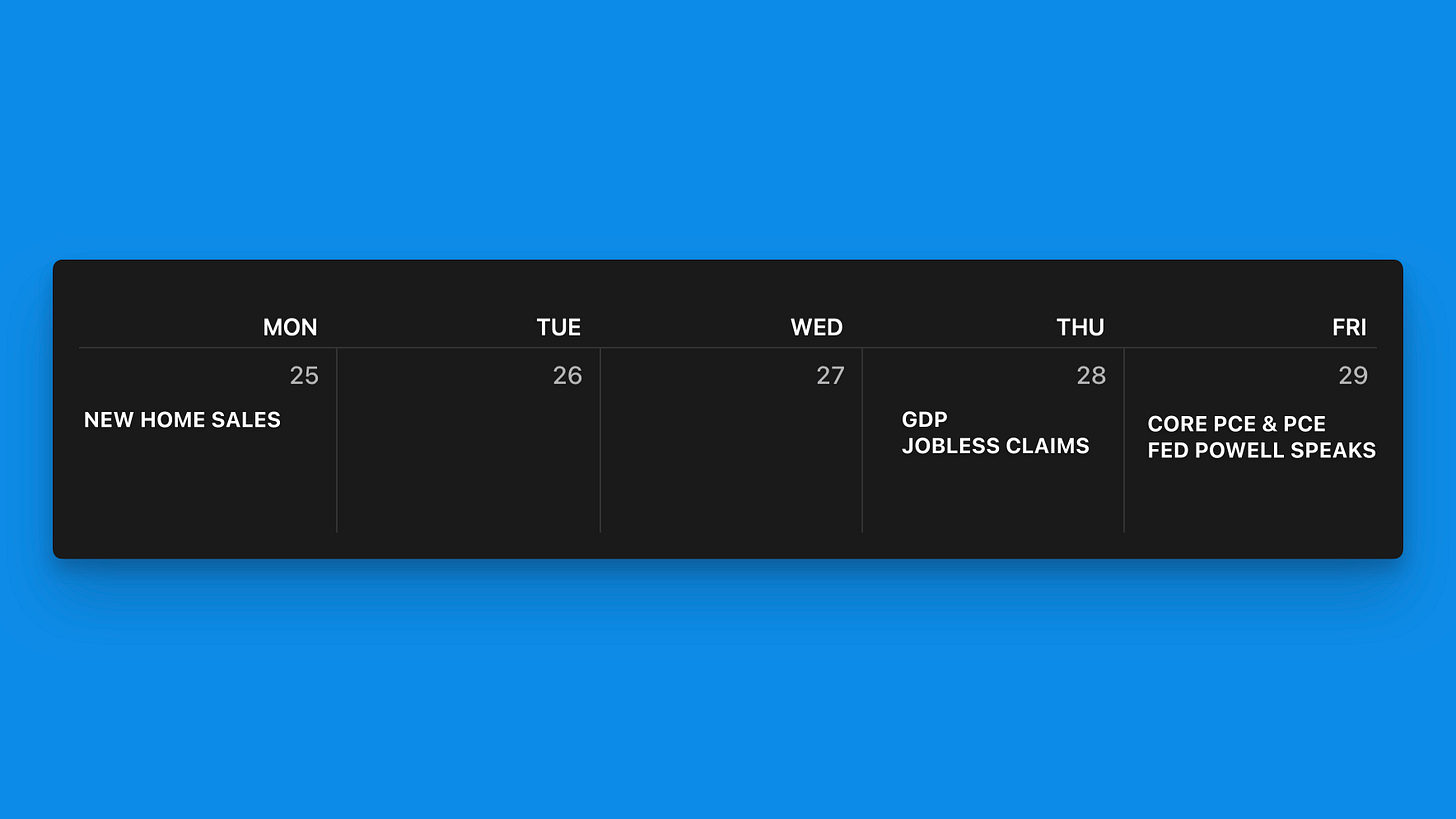

Investors will be keeping an eye on any comments from Fed officials about their plans for monetary policy.

As for economic reports, we'll get New Home Sales data on Monday, and Personal Income and the PCE price index (the Fed's favorite inflation measure) on Thursday.

Keep in mind that mortgage markets will close early on Thursday and will be closed on Friday for Good Friday.