Rate Cut Looms - August 26 - Weekly Mortgage Update

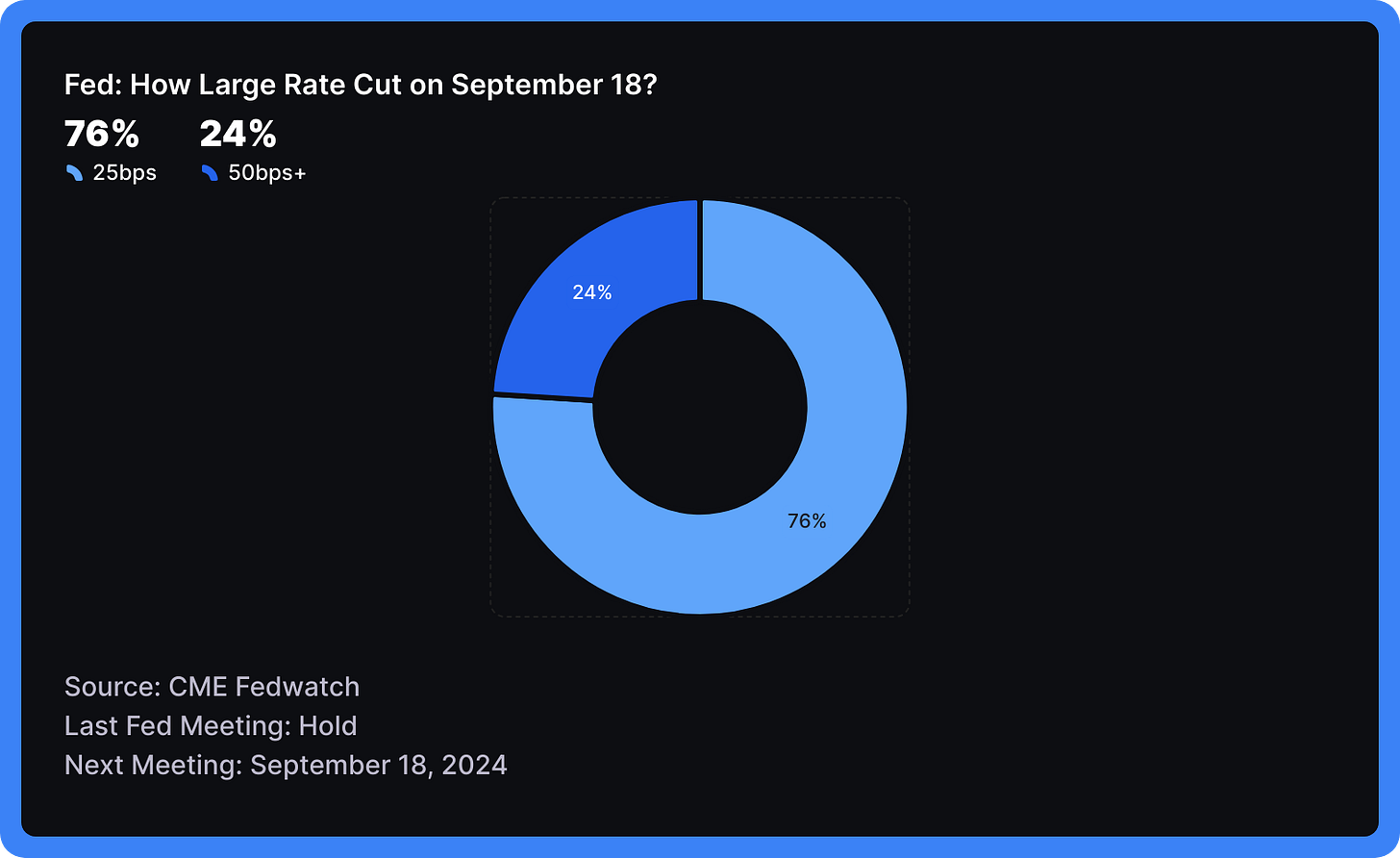

The mortgage market is in a holding pattern as all eyes turn to a likely .25% Fed rate cut on September 18th, pending key economic reports.

Request a Quote

A complete workup of your payment and closing costs on any home purchase or existing mortgage refinance. (no credit checks, Texas-only)

⭐️ Check This Out

In today's market, even if you're not a millionaire, there's a good chance your home is trying to be one. 8.5% of U.S. homes now worth over $1 million.

Zillow is downgrading its crystal ball slightly—predicting a 1.8% home value increase and 4.1 million sales in 2024.

The Fed is flirting with a rate cut, but just like trying to pick a favorite child, they couldn't commit in July—but September looks likely.

Apparently, if you’re not living in Gahanna, OH, you’re missing out on the trendiest real estate in America—for two years running.

Looks like the job numbers were doing some creative accounting — turns out we’ve got 818,000 fewer jobs than we thought.

📊 Market Update

This week in the mortgage world felt like one long waiting game. The big event everyone was eyeing? A Friday speech by Federal Reserve Chair Jerome Powell at the Jackson Hole symposium.

People were hoping for some hints about what might happen with interest rates in the near future. But leading up to that, things were pretty quiet.

On Monday, the bond market—where a lot of this interest rate stuff gets sorted out—was almost at a standstill. Mortgage rates barely budged, and there wasn't much action to talk about. It seemed like everyone was holding off on making big moves until they heard more from the Fed.

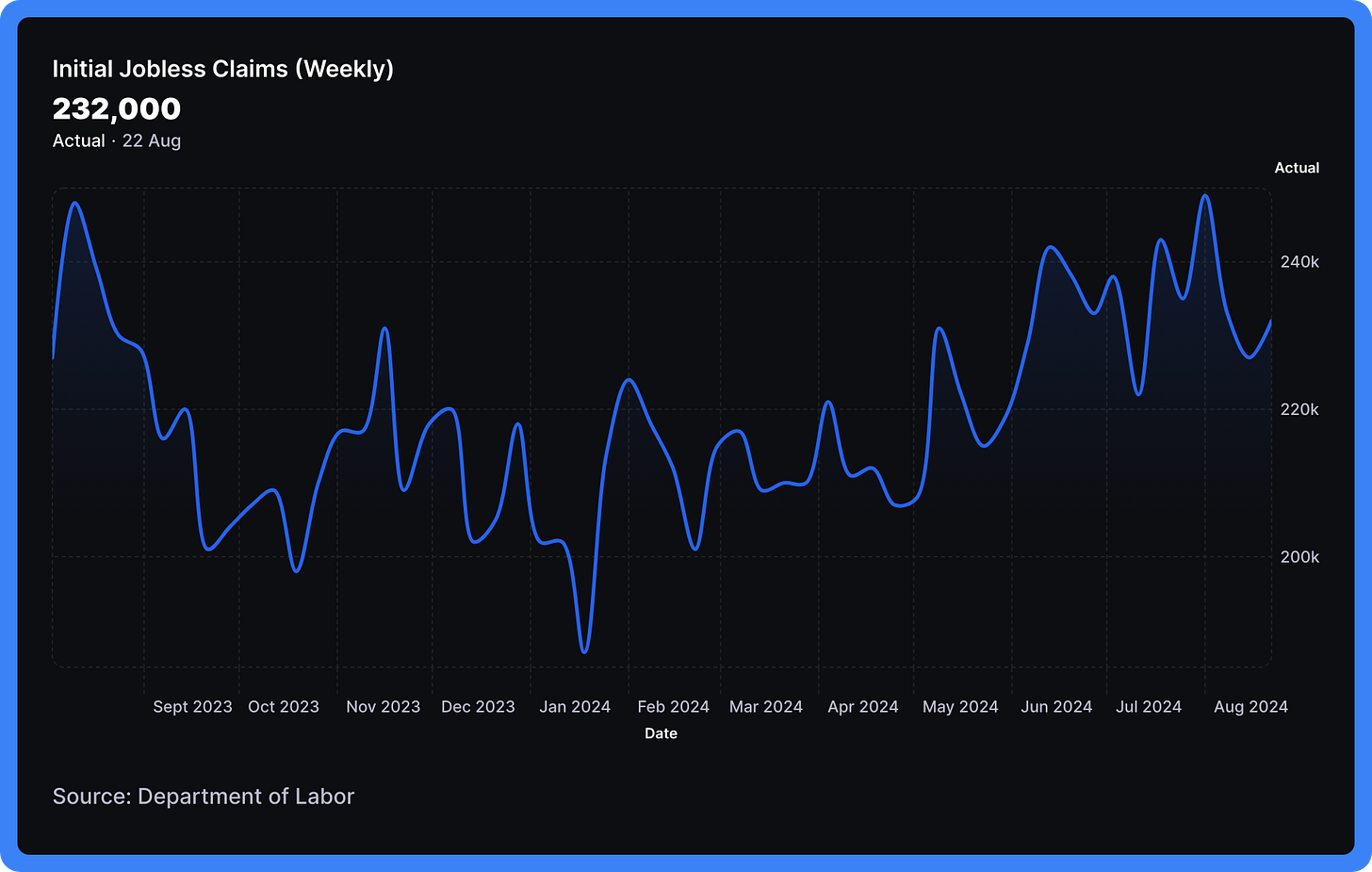

Midweek, attention shifted to some job data that got updated on Wednesday. There was a bit of confusion at first, especially since the new numbers showed 818,000 fewer jobs than originally thought; year-over-year. But the market quickly shrugged it off, and everything went back to normal.

Then Friday arrived, bringing Powell’s big speech…

Inflation vs. Employment

We've seen some compelling data recently, but it's painting a picture with two very different brushstrokes. On one side, we have inflation indicators suggesting the economy might be cooling off. On the other, we have a labor market that's still running hot.

It's like trying to decide if you need a sweater or sunscreen - the signals are mixed!

This duality has left the market uncertain. Will the Fed cut rates? By how much? When?

Predictions have been bouncing around like a pinball machine.

Many thought Powell might keep his cards close to his chest, especially with more economic data to come before the Fed's next meeting. It was like waiting for the river card in Texas Hold'em - that final piece of information that could make or break his hand.

Would he go all-in on a rate cut, or would he fold and stay the course?

In the end, Powell's speech at Jackson Hole was more revealing than many expected. He strongly hinted at a policy shift, saying "the time has come for policy to adjust" and "the direction of travel is clear."

So, it’s finally official. A rate cut is coming on September 18th.

.25% Rate Cut: Most Likely

The odds have slightly shifted this week in favor a single, .25% rate cut from the Fed. It’s still a few weeks away, and while the clock is ticking, we have some upcoming reports that could shift the odds.

Revised Q2 GDP: The Commerce Department will release the revised second-quarter Gross Domestic Product (GDP) data, which will provide an updated view of economic growth during that period.

Personal Consumption Expenditures (PCE) Report: This report, which includes the Fed’s preferred inflation measure, the PCE price index, will be crucial in assessing inflation trends. The July PCE data is expected to be released on August 30, 2024.

Non-farm Payrolls: The August non-farm payrolls report, which includes data on job creation and the unemployment rate, will be released on September 6, 2024. This report is a key indicator of labor market health.

Consumer Price Index (CPI): The August CPI report, which measures inflation, will be released on September 13, 2024. This will provide further insights into inflation trends.

Later This Week

The upcoming week features several important economic releases, with the most crucial data coming at the end of the week. While speeches by Fed officials midweek may provide insights into monetary policy thinking, Friday stands out as the most significant day for economic indicators.

This is primarily due to the release of the Core PCE Price Index, which is the Federal Reserve's preferred measure of inflation.

Wednesday, 28

Fed Waller: Speech by Federal Reserve Governor Waller

Fed Bostic: Speech by Federal Reserve Bank of Atlanta President Bostic

Thursday, 29

Core PCE Prices: Measure of inflation excluding food and energy

GDP: Gross Domestic Product, measure of economic growth

Jobless Claims: Weekly report on unemployment insurance claims

Home Sales: Data on sales of existing homes

Fed Bostic: Another speech by Federal Reserve Bank of Atlanta President Bostic

Friday, 30

Core PCE Price Index: Another measure of inflation excluding food and energy

PCE Price Index: Personal Consumption Expenditures Price Index, a measure of inflation

Personal Spending: Data on consumer spending patterns