Market's Cha-Cha Dance - Sept 30 - Weekly Mortgage Update

This week’s markets waltz through fluctuating bond yields, shifting consumer confidence, and uncertain Fed actions, highlighting an unpredictable economic rhythm.

Request a Quote

A complete workup of your payment and closing costs on any home purchase or existing mortgage refinance. (no credit checks, Texas-only)

⭐️ Check This Out

August 2024 marks the 13th consecutive month of rent declines, with median rents down slightly across all unit sizes.

Redfin says homes are more affordable now—just like 2020, except you’ll need an income boost and a time machine to feel the difference.

Home sales took a dip in August—again. But hey, at least there's 22.7% more inventory to scroll through while rates and prices still give buyers heart palpitations.

The economy’s 3% growth in Q2? A polite “you’re welcome” from consumers and businesses, while inflation inches down, still trying to impress the Fed.

📊 Market Update

Is anyone else feeling like the market has been doing the Cha-Cha this week? One step forward, two steps back—and just when we thought we had a rhythm, the dance floor changed.

Let’s break it down—grab your coffee, or, if it’s been that kind of week, maybe something a little stronger, and let’s dive into this week's market shuffle.

Post-Fed Dance Off

After last week's Fed rate cut, bonds have been acting like they just got some confusing choreography. On one hand, we saw some steepening of the yield curve—fancy finance talk for the fact that short-term bonds are looking a little less shaky than the long ones.

And long-term bonds?

They're wobbling more than my confidence during a TikTok dance challenge.

Monday kicked off with weaker bonds and rising 10-year yields, which climbed to 3.775%. It wasn’t a major blow, but let’s just say we’ve seen better days. The highlight was the S&P Global Services PMI, which came in stronger than expected.

Tuesday brought us some mixed signals, with Consumer Confidence taking a bit of a nosedive to 98.7 from last month’s 105.6 (folks must still be nervous about job prospects), and housing prices barely inching forward.

So, what does all this mean for us?

Well, just like a TikTok dance, the markets seem to be improvising—one day up, the next day down. With consumer confidence dipping and housing prices stalling, it's clear that we’re not quite in the smooth part of the routine yet.

But hang tight—if there’s one thing we know about this market, it’s that it loves to keep us guessing.

Is the Fed Really Calling the Shots?

You might be asking yourself, "What is really going on with mortgage rates lately?"

It turns out, the Fed's not pulling all the strings.

Sure, they cut the rate by 50 basis points, but markets have been more interested in job reports and inflation. In fact, Friday’s PCE inflation data showed that while inflation is kind of under control, the core number—what really matters to mortgage rates—remains stubborn at 2.7%.

So yeah, inflation is like that one friend who promises to leave early but always sticks around, lingering awkwardly when you're trying to clean up.

Still, Friday offered a glimmer of hope as mortgage applications jumped 11% week-over-week. Even refinances are making a comeback, rising 20%. Could it be that people are starting to feel better about locking in rates?

If the PCE data doesn’t start behaving, though, the Fed might be forced to take the stage for another round of rate cuts. The market's got its eyes glued to November, where the debate rages on.

Will it be 25 bps or 50 bps?

Yield Curve—Predictor of Recession or Just Another Bad Day?

Historically, when the yield curve steepens, like it did this week, it can signal one of two things:

Higher unemployment could be coming. When long-term rates rise faster than short-term rates, it can be a sign that investors are feeling a little jittery about the future—and when investors are nervous, it often means they’re bracing for slower economic growth, which can lead to job losses.

The economy is trying to bounce back, but it’s having some... issues. Picture the economy as someone trying to jog after pulling a muscle. It’s limping along, trying to keep up, but every once in a while, it stumbles and needs a breather. That’s what happens when short-term rates stay relatively low while long-term rates creep up—the economy is working through its challenges, but it’s far from a smooth recovery.

So far, jobless claims are still low, sitting at 218k, which means the job market is holding steady for now. But if we start to see unemployment ticking up, that could be the Fed’s cue to jump in with another round of rate cuts to try and keep things in balance.

While I’m not sounding the recession alarms just yet, let’s just say I’m watching closely—kind of like when you’re binging a suspenseful Netflix series and the tension is building.

You know something’s coming, but you're not quite sure when it’ll hit.

Later This Week

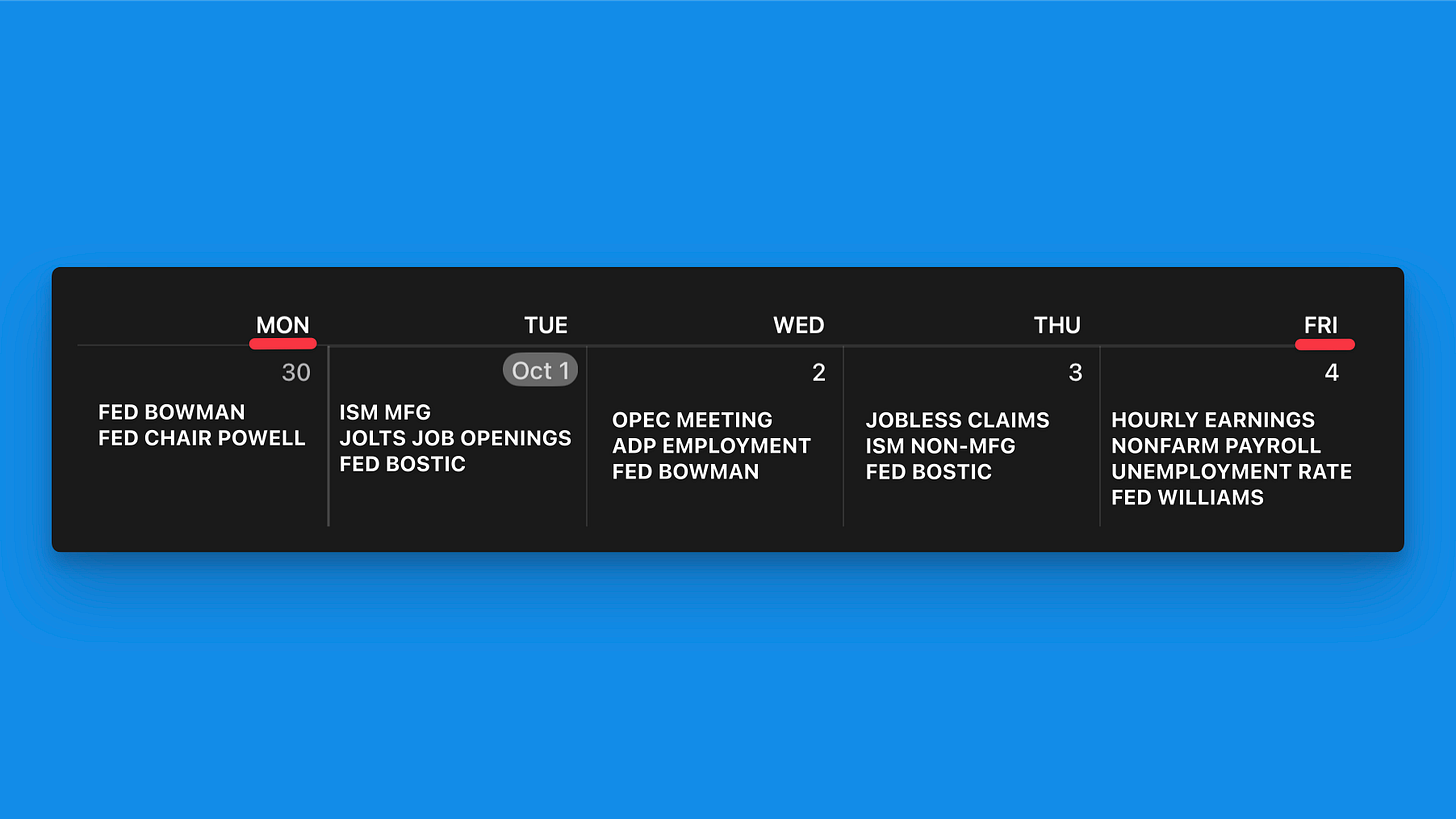

The week is packed with crucial economic indicators and Federal Reserve speeches, culminating in Friday's comprehensive employment report.

Monday, September 30

Fed Bowman: Speech by Federal Reserve Governor Michelle Bowman

Fed Chair Powell: Speech by Federal Reserve Chair Jerome Powell

Tuesday, October 1

ISM mfg: Manufacturing index from the Institute for Supply Management

JOLTS job openings: Job Openings and Labor Turnover Survey, measuring job vacancies

Fed Bostic: Speech by Federal Reserve Bank of Atlanta President Raphael Bostic

Wednesday, October 2

OPEC meeting: Organization of the Petroleum Exporting Countries meeting

ADP employment: Private sector employment report by Automatic Data Processing

Fed Bowman: Another speech by Federal Reserve Governor Michelle Bowman

Thursday, October 3

Jobless claims: Weekly report on unemployment insurance claims

ISM non-mfg: Non-manufacturing index from the Institute for Supply Management

Fed Bostic: Another speech by Federal Reserve Bank of Atlanta President Raphael Bostic

Friday, October 4

Hourly earnings: Report on average hourly wages

Nonfarm payroll: Monthly employment situation report

Unemployment rate: National unemployment rate

Fed Williams: Speech by Federal Reserve Bank of New York President John Williams