Jobs Surge Rattles Rate Cuts - Oct 7 - Weekly Mortgage Update

A stronger-than-expected jobs report may derail expected Fed rate cuts, potentially keeping mortgage rates on the rise.

Request a Quote

A complete workup of your payment and closing costs on any home purchase or existing mortgage refinance. (no credit checks, Texas-only)

⭐️ Check This Out

84% of homeowners are holding onto sub-6% mortgage rates like they’ve found Willy Wonka’s golden ticket—and who can blame them?

Powell showed up like Arnold to the rate cut bash—promising not to be the “party poopa,” but making sure the party doesn't get too wild either.

Pending home sales inched up 0.6% in August, as buyers channel their inner Dr. Strange, stuck in a time loop waiting for mortgage rates to fall. "Dormammu, I've come to bargain..."

Pending U.S. home sales remained flat compared to last year, marking the first time since January without a decline.

📊 Market Update

Well, well, well. Just when we thought we had the economic script all figured out, the job market decided to rewrite the entire plot.

Remember last month when we were all abuzz about potential rate cuts? The job market just dropped a bombshell that might make the Fed reconsider its entire storyline.

Friday's jobs report came in like a wrecking ball, smashing expectations with 254,000 new jobs (vs. 140,000 forecast). The unemployment rate? It dipped to 4.1%, giving a cheeky wink to those who predicted 4.2%.

And wages? Up 0.4% for the month.

Now, I can almost hear the gears turning in your head. "But isn't a robust job market a good thing?" you might ask. Well, in the topsy-turvy world of mortgage rates, it's not quite that simple.

When the job market flexes its muscles like this, it tends to make inflation hawks nervous. Why? Because strong employment often leads to wage growth, which can fuel inflation.

And inflation, my friends, is the archenemy of low interest rates.

The Bond Market Blues

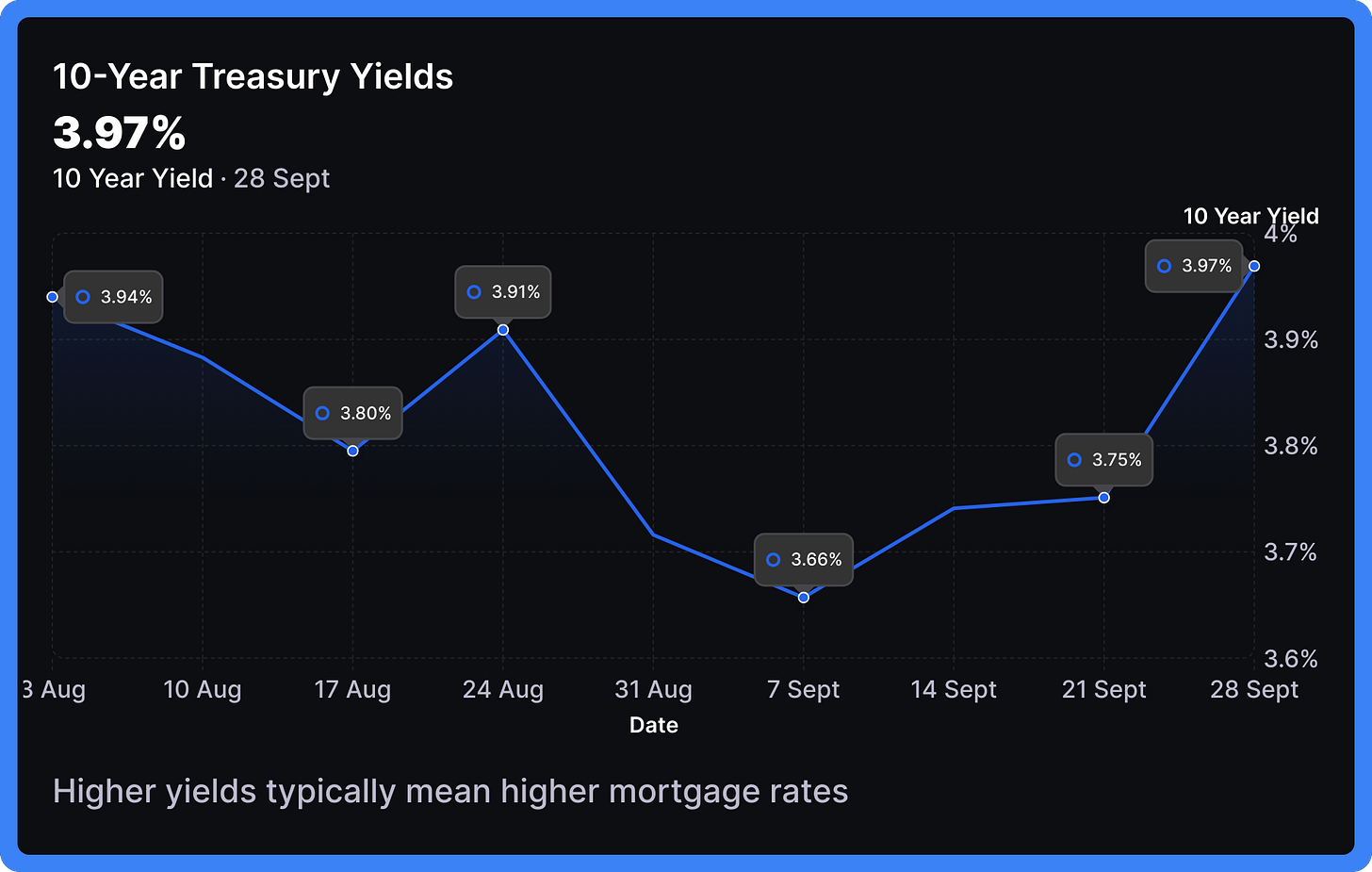

This is where our pals in the bond market come in. They're like the canaries in the coal mine of the financial world, and right now, they're singing a pretty high-pitched tune. Bond prices took a sharp dive faster than you can say "refinance," which means yields shot up significantly.

Here's a key point that often trips people up: bonds and yields have an inverse relationship. They move like those old-fashioned weight scales - when one side goes up, the other goes down. When bond prices fall, yields rise, and vice versa. It's a fundamental concept in finance, but it can be counterintuitive at first glance.

Why does this matter for mortgages? Well, as Treasury yields climb, mortgage rates typically follow. They're closely linked, so when you see yields rising, you can expect mortgage rates to increase as well.

But here's the question on everyone's mind: Is this jobs report the start of a new trend, or just a blip on the radar? Are we looking at sustained higher rates, or will this be a short-lived spike?

The Fed's Next Move

Up until now, we thought Fed was going to be handing out rate cuts like candy at a Halloween. 🎃 Well, this jobs report just changed the game. It's like the Fed was all set to cut rates, and then the job market said…

Now, don't get me wrong. One strong jobs report doesn't mean the economy is suddenly bulletproof. But it does make the Fed's job a lot more interesting. They're probably scratching their heads right now, wondering if they should stick to their "we're done hiking rates" guns or start polishing their hawks' beaks again.

One thing's crystal clear: we're in for an interesting ride over the next 30 days as we approach November presidential elections. This jobs report has certainly shaken things up, leaving us all wondering what's next for rates.

Will the Fed stick to its guns or pivot? Will inflation make a comeback tour?

Only time will tell.

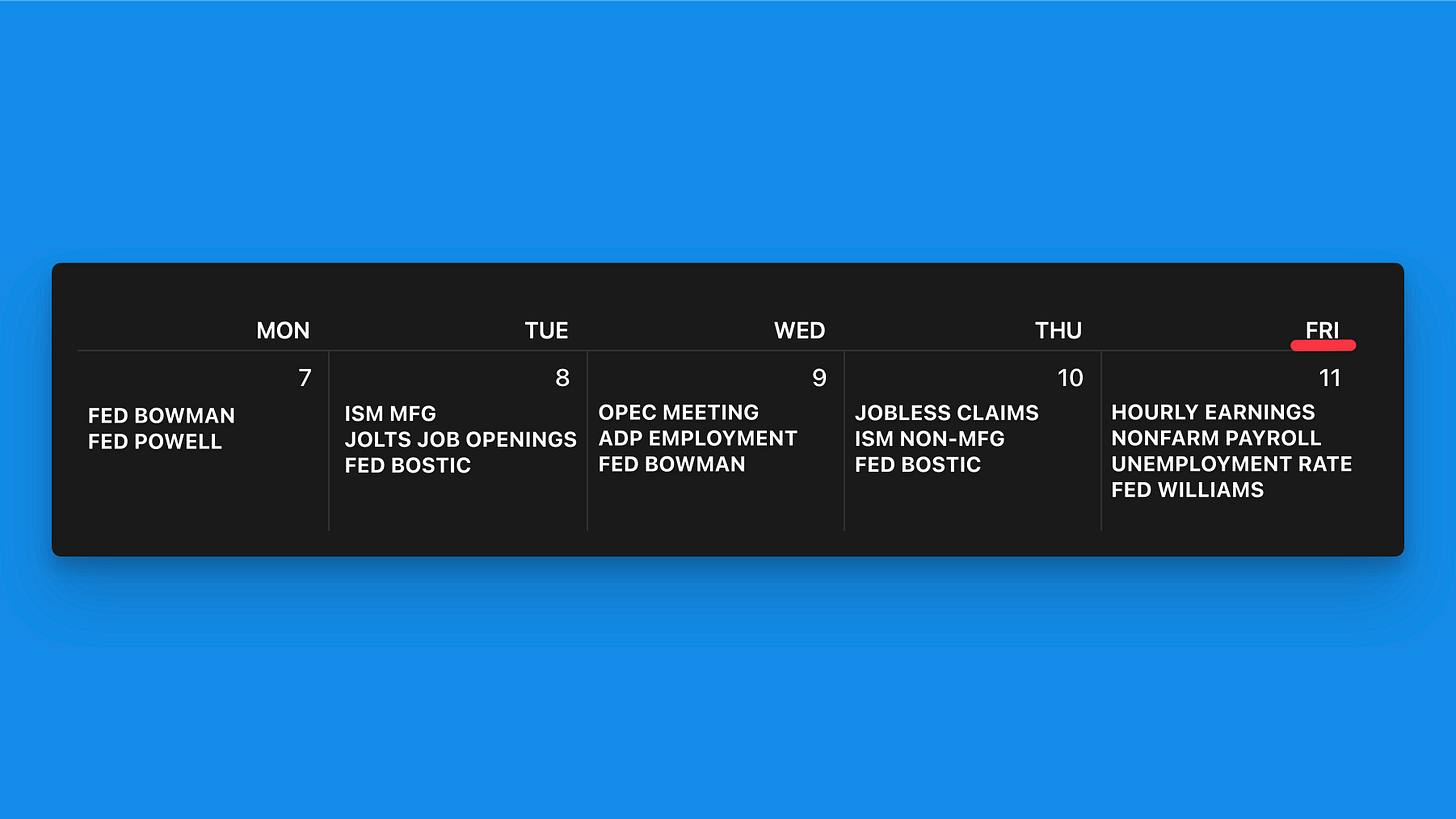

Later This Week

A week packed with Fed speeches, key economic indicators, and labor market data. Highlights include an OPEC meeting, ISM reports, and Friday's comprehensive employment figures.

Monday, October 7

Fed Bowman: Speech by Federal Reserve Governor Michelle Bowman

Fed Powell: Speech by Federal Reserve Chair Jerome Powell

Tuesday, October 8

ISM MFG: Report on manufacturing activity in the US

JOLTS Job Openings: Data on job openings and labor turnover

Fed Bostic: Speech by Federal Reserve Bank of Atlanta President Raphael Bostic

Wednesday, October 9

OPEC Meeting: Meeting of the Organization of the Petroleum Exporting Countries

ADP Employment: Private sector employment report

Fed Bowman: Another speech by Federal Reserve Governor Michelle Bowman

Thursday, October 10

Jobless Claims: Weekly report on unemployment insurance claims

ISM Non-MFG: Report on non-manufacturing (services) activity in the US

Fed Bostic: Another speech by Federal Reserve Bank of Atlanta President Raphael Bostic

Friday, October 11

Hourly Earnings: Data on average hourly earnings for workers

Nonfarm Payroll: Comprehensive employment report

Unemployment Rate: Percentage of the labor force that is unemployed

Fed Williams: Speech by Federal Reserve Bank of New York President John Williams