Job Slowdown, Rate Relief? - Sept 9 - Weekly Mortgage Update

Fewer jobs might mean cheaper mortgages soon, thanks to some recent economic reports and the Fed eyeing rate cuts.

Request a Quote

A complete workup of your payment and closing costs on any home purchase or existing mortgage refinance. (no credit checks, Texas-only)

⭐️ Check This Out

Job openings are disappearing faster than coffee ☕ at a morning meeting.

Mortgage rates have decreased due to speculation of a Fed rate cut, creating a potential boost for homebuying and refinancing opportunities.

August 2024 saw private payrolls increase by only 99,000, the smallest gain since 2021, falling short of the forecasted 170,000.

Want a home near a top school? Be ready to pay up—unless you’re okay with swapping that fireplace for a good report card.

📊 Market Update

This week was full of economic reports that impacted the mortgage market, but one of the biggest takeaways was the weak job data.

The Job Openings report showed fewer open positions than expected, and Friday's Nonfarm Payrolls came in lower than predicted, which suggests the job market is slowing down. A slower job market often makes bond yields go down, and when bond yields drop, mortgage rates tend to follow.

Another important factor was the ISM Services report, which showed that prices in the service sector are still rising. This could keep inflation higher, but for now, it wasn’t enough to push mortgage rates up much.

Overall, rates remained steady, with a slight downward trend as the week ended.

Fewer Jobs, Lower Mortgage Rates?

The JOLTS report shows how many jobs are available in the U.S. and how often people are quitting. This week, the report revealed fewer job openings than expected. When companies slow down their hiring, it signals that the economy might be cooling off.

But what does this mean for mortgage rates?

When the economy slows, investors tend to put their money into bonds, which are considered safe investments. As more investors buy bonds, the yields (returns on those bonds) go down. Mortgage rates follow those yields, so when bond yields drop, mortgage rates often do, too.

For the mortgage industry, a slowdown in the job market could provide some relief in terms of lower rates, making loans more affordable for borrowers. While this might not be great news for the broader economy, it can create opportunities for mortgage professionals to help clients secure better deals.

Did you know that JOLTS data goes all the way back to 2000? It's a relatively new report, but it gives us a long-term look at job market trends over the past two decades.

September Surprise? Fed Rate Cut Predictions

All eyes are on the Federal Reserve's next meeting on September 18, 2024. The big question: How much will they cut interest rates?

Right now, the market is betting on a rate cut, but the size is up for debate. There's a 70% chance of a smaller 0.25% cut, and a 30% chance of a bigger 0.50% cut. Why does this matter? A bigger cut could mean lower borrowing costs for things like mortgages and car loans.

But here's the twist: These odds could change quickly. The Consumer Price Index (CPI) report coming out next Wednesday, September 11, could shake things up. The CPI tells us how fast prices are rising. If it shows inflation is cooling down more than expected, we might see those odds shift towards a bigger rate cut.

Later This Week

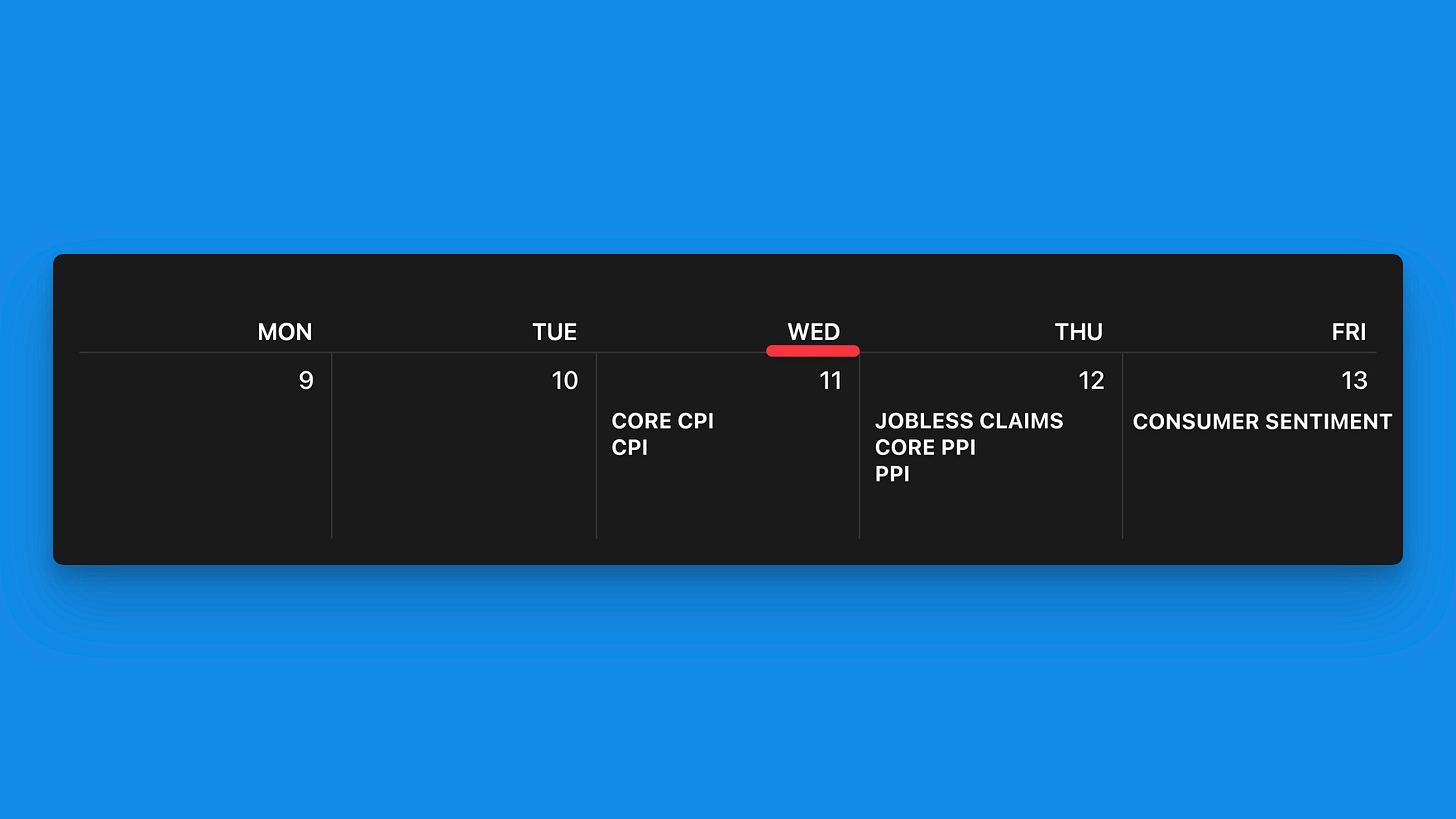

The upcoming week features several important economic releases, with Wednesday standing out as the most significant day.

On Wednesday, we'll see the release of both Core CPI and CPI reports, providing crucial insights into inflation trends. Thursday follows with Jobless Claims and PPI data, offering a look at employment and producer-side inflation. The week concludes on Friday with the Consumer Sentiment report.

Wednesday, 11

Core CPI (Consumer Price Index excluding food and energy)

CPI (Consumer Price Index, measures changes in the price level of a basket of consumer goods and services)

Thursday, 12

Jobless Claims (measures the number of people filing for unemployment benefits)

Core PPI (Producer Price Index excluding food and energy)

PPI (Producer Price Index, measures changes in the price level of goods and services from the perspective of producers)

Friday, 13

Consumer Sentiment (measures consumer attitudes and expectations about the economy)