Fed Week, Pause Expected - Mar 18 - Weekly Mortgage Update

The latest inflation data surprised investors and reduced the chances of a Fed cut in June. The market expects a pause this week by the Fed.

Request a Quote

A complete workup of your payment and closing costs on any home purchase or existing mortgage refinance. (no credit checks)

⭐️ Check This Out

NAR settles lawsuit, bids adieu to MLS compensation rule. $418 million later, they're still pleading innocence. Commission negotiations? That’s between you and the seller now.

Retail therapy is back. After a January slump, shoppers are once again swiping their cards with gusto.

The real estate buffet just got a lot more tempting. New listings are popping up like spring flowers, especially in the South. Sellers are finally emerging from their "rate lock" hibernation, ready to cash in on that sweet, sweet home equity.

Stubborn inflation strikes again. The Fed's rate cuts are on hold as prices continue to climb, leaving everyone wondering when this economic rollercoaster will end.

Baby boomers are staying in their homes longer than average, making it harder for younger generations to break into the market. Can you blame them?

📊 Market Update

Last week, some news about inflation caught everyone's attention and kind of threw a wrench in the works for mortgage markets. Even though there was also some info about consumer spending being lower than expected, it wasn't nearly as big a deal to investors.

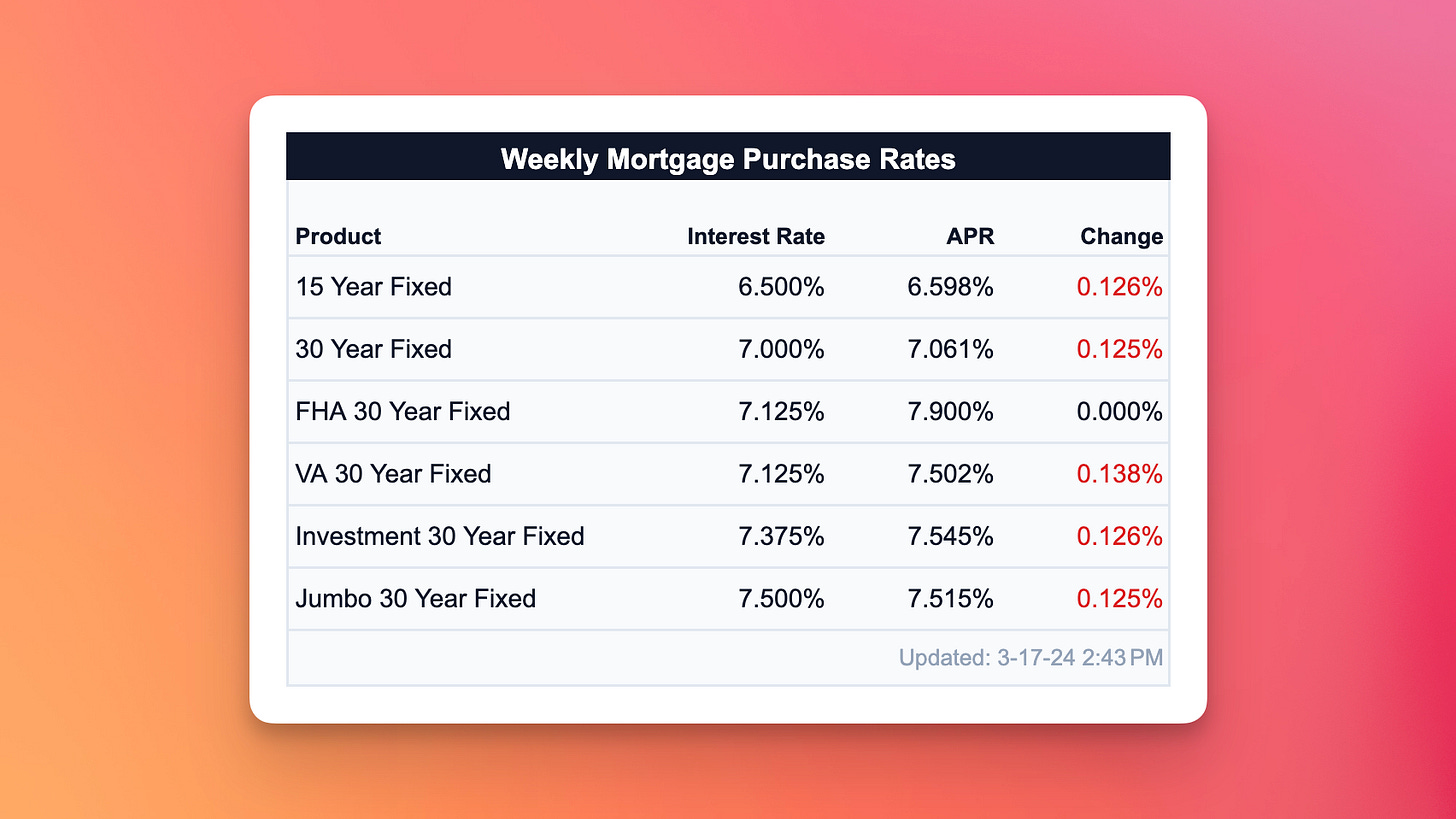

When all was said and done, mortgage rates actually went up a bit, and the market doubled down on a “no change” decision for this month’s Fed rate decision.

June Pivot Chances Dropping

It seems like the folks over at the Federal Open Market Committee (FOMC) are feeling pretty good about their choice to hold off on cutting rates right away, especially after seeing the latest inflation numbers.

At the start of the year, inflation was looking pretty tame, and the economy was chugging along nicely. The Fed just wanted a little more proof that inflation was going to keep heading down. Even just a week ago, Fed officials were brushing off January's data as a bit of a fluke and were still determined to start easing up on policies soon.

Turns out, being patient paid off for them. A rate cut next week? Not happening.

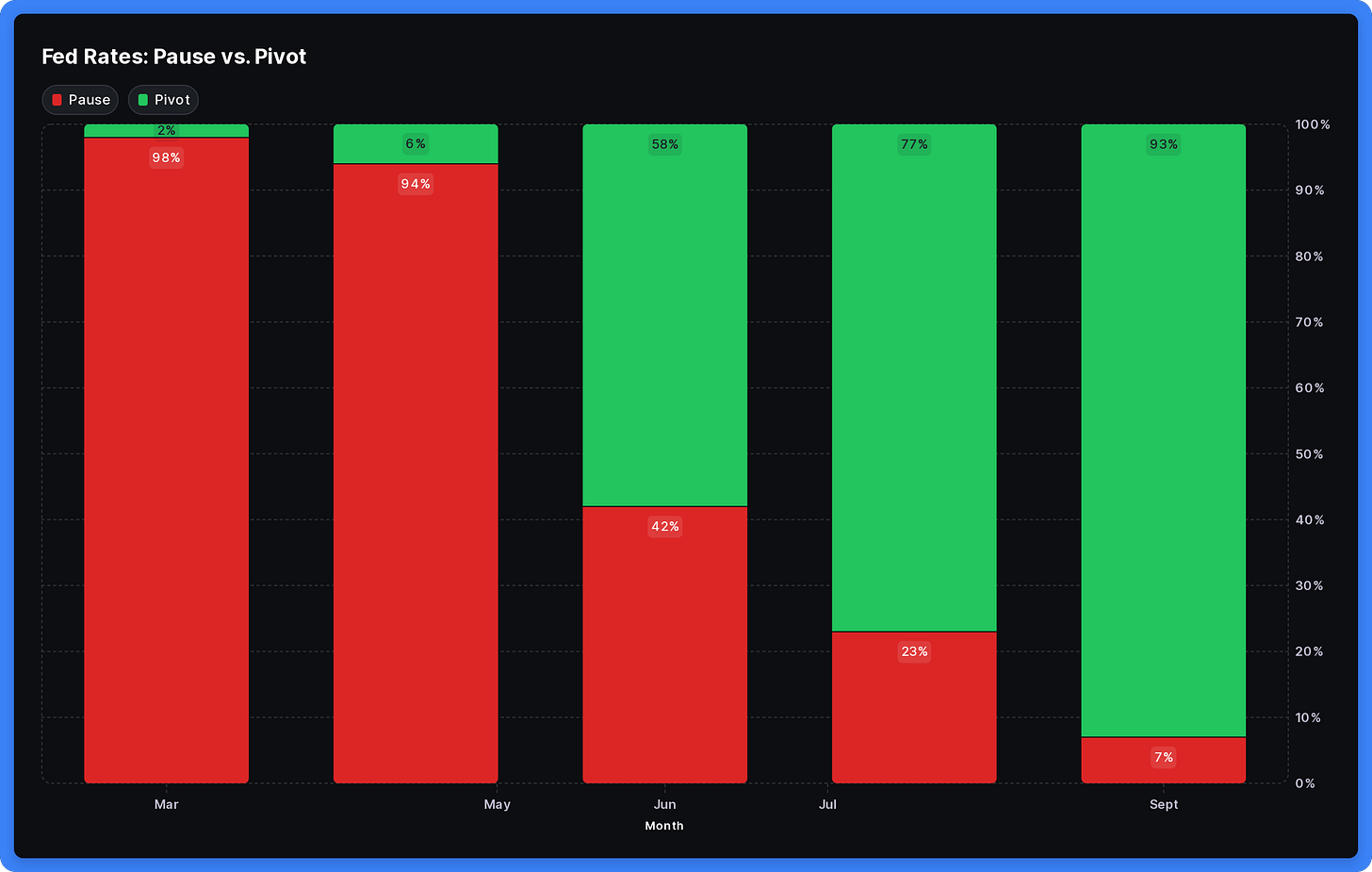

While the market still expects a solid chance of a rate reduction in June, the more likely month would be July or September.

Core CPI Surprise

The Consumer Price Index is like the MVP of inflation indicators - everyone's always keeping an eye on it. But here's the thing: sometimes, the CPI can be a bit misleading.

It's kind of like when you're trying to figure out how much your groceries are going to cost, but you've got a couple of wild cards in your cart, like that fancy cheese you splurged on or the extra-pricey cuts of meat. Those items can make your total bill swing up or down quite a bit, even if the prices of your regular staples haven't changed much.

That's why economists and investors often prefer to look at something called the "Core CPI." It's like the CPI's more reliable, level-headed sibling. The core CPI takes out the prices of food and energy, which tend to bounce around a lot from month to month. By removing these volatile categories, we get a clearer picture of the underlying inflation trend.

So, when the core CPI comes in higher than expected, like it did in February, it's a bit of a red flag. It means that prices for a lot of the things we buy are going up faster than anticipated. And when inflation is running hot, it can put pressure on the Fed to take action, like raising interest rates to cool things down.

Consumer Spending: Meh

It's no secret that when consumers are feeling good about their financial situation, they tend to spend more. And when they spend more, it's generally a good sign for the economy. So, when retail sales numbers come out, everyone pays attention.

In February, retail sales did go up, but not quite as much as the experts were hoping for. And when you factor in inflation, the picture looks a bit less rosy. Essentially, even though people were spending more dollars, they weren't necessarily getting more stuff for their money.

But here's an interesting tidbit: some of the biggest jumps in spending were on things like cars, electronics, and building materials. This could suggest that consumers are feeling confident enough to make bigger purchases, like upgrading their ride or tackling a home renovation project. On the flip side, it could also mean that people are having to shell out more for these items because of inflation.

Later This Week

This week is Fed week, so Wednesday is our biggest day. If there is a surprise (like a pivot or hike), then expect a lot more interest rate volatility.

I’m closely watching the markets on three key days, in particular:

Tuesday - Building permits, housing starts

Wednesday - Fed rate decision + FOMC statement

Thursday - Jobless claims, existing home sales