Fed Cut Predictions Rise - Sept 2 - Weekly Mortgage Update

Core PCE inflation data suggests a gradual move toward the Fed's 2% target, increasing speculation about a possible larger rate cut in the upcoming meeting.

Request a Quote

A complete workup of your payment and closing costs on any home purchase or existing mortgage refinance. (no credit checks, Texas-only)

⭐️ Check This Out

It’s official—buying a house now comes with a free side of existential dread.

In June, U.S. home prices hit a new high, as if limited inventory and high demand joined forces to outdo even the mortgage rates in their upward climb.

Jerome Powell's latest speech reminds us that the Fed's balancing act between taming inflation and boosting employment could be its next Olympic event.

July's 5.5% drop in pending home sales is the market's way of reminding us that affordability is as elusive as a unicorn on roller skates.

The U.S. economy just got a surprise upgrade, thanks to consumers who apparently took "spending power" a bit too literally.

📊 Market Update

This past week in the mortgage market was a bit like watching a slow-moving chess match—lots of anticipation, but not a whole lot of dramatic moves.

The big news was the release of inflation data, which showed Core PCE (a key measure of inflation) coming in at 0.2% month-over-month, meeting expectations.

This suggests inflation is slowly moving towards the Federal Reserve's 2% target.

Meanwhile, jobless claims were slightly lower than expected, indicating a still-strong job market. These factors are important as they influence the Federal Reserve's decisions on interest rates, which in turn affect mortgage rates.

What is Core PCE and Why Does it Matter?

Core PCE stands for "Core Personal Consumption Expenditures." It's a mouthful, right? It's like the government's way of saying “We're watching what you buy, but we pinky promise we're not stalking you.”

Let's break it down:

"Core" means it doesn't include food and energy prices. Why? Because these prices can jump around a lot.

"Personal Consumption Expenditures" is just a fancy way of saying "the stuff people buy."

So, Core PCE measures how much prices are changing for most things we buy, except food and gas.

Why is this number so important? It's the Federal Reserve's favorite way to measure inflation. When the Fed talks about their 2% inflation target, they're looking at Core PCE.

Last week, Core PCE came in at 0.2% for the month. That might seem small, but it adds up over a year. If prices went up 0.2% every month, that would be about 2.4% for the whole year.

Why should you care? Well, inflation affects everything:

Your money: If prices go up faster than your paycheck, you can buy less stuff.

Interest rates: When inflation is high, the Fed often raises interest rates to slow it down. This can make borrowing more expensive - think mortgages, car loans, and credit cards.

The economy: If inflation gets too high, it can hurt economic growth. But if it's too low, that can be bad too.

The Federal Reserve has been targeting 2% inflation since 2012. Before that, they didn't have an official target!

If inflation stays under control, it could lead to more stable prices and possibly lower interest rates in the future. This could make it easier to buy a home, start a business, or just manage your daily expenses.

Fed: A Larger Cut?

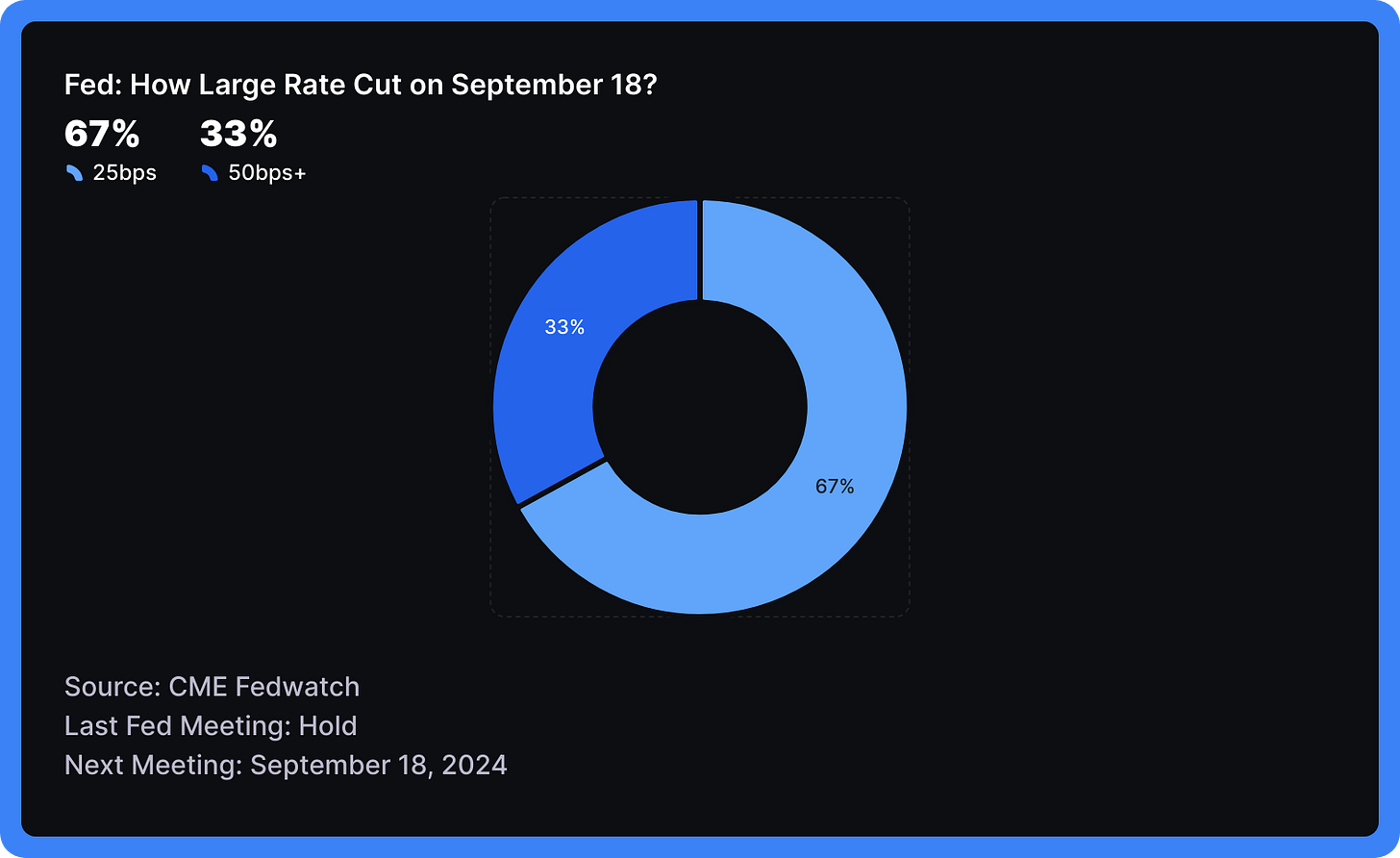

Looks like the chances of a bigger rate cut are growing! The latest predictions show there's now a 33% chance - that's 1 in 3 - that the Federal Reserve might lower interest rates by half a percent at their September 18th meeting.

This is a pretty big deal.

Usually, the Fed moves rates by just a quarter percent at a time. So, a half percent cut would be like the Fed stepping on the gas pedal of the economy.

What's driving this?

It could be signs that inflation is cooling off faster than expected, or worries about economic growth. Either way, it's got people talking. Remember, nothing's certain - there's still a 67% chance of a smaller quarter percent cut.

Later This Week

The upcoming week is set to be a crucial one for economic data, with a strong focus on employment. After Labor Day on Monday, we'll see various reports throughout the week, including ISM indices, JOLTS job openings, and ADP employment figures.

The week culminates on Friday with the release of the comprehensive monthly jobs report, featuring nonfarm payrolls, unemployment rate, and hourly earnings, alongside a speech from Fed Governor Waller.

Monday, September 2

Labor Day (US holiday). No major reports scheduled.

Tuesday, September 3

ISM MFG (Institute for Supply Management Manufacturing index): Measures the health of the U.S. manufacturing sector.

Wednesday, September 4

JOLTS Job Openings (Job Openings and Labor Turnover Survey): Tracks job openings, hires, and separations in the U.S. labor market.

Thursday, September 5

Jobless Claims: Weekly report on the number of new unemployment benefit claims.

ADP Employment (ADP National Employment Report): Estimates private sector employment changes.

ISM Non-MFG (Institute for Supply Management Non-Manufacturing index): Assesses the state of non-manufacturing sectors in the U.S. economy.

Friday, September 6

Hourly Earnings: Measures average hourly wage growth for U.S. workers.

Nonfarm Payroll: Reports the number of new jobs created in the U.S. economy, excluding farm workers.

Unemployment: Provides the percentage of the labor force that is unemployed and actively seeking employment.

Fed Waller: Potential speech or comments by Federal Reserve Governor Christopher Waller, which could provide insights into monetary policy.